Chris McConnell & Associates since 2003, provides independent, no-conflict expert consulting around regulated, licensed or non-licensed entities & individuals, fiduciary & securities, banking, insurance industry standard of care covering fiduciary, securities, corporate governance, FINRA, commodities, real estate, intellectual property, crypto assets, elder finanancial abuse & exploitation, fiduciary audits, forensic tracing, investment due diligence, investment policy, trade & risk analysis, insurance & information asymmetry among a wide variety of other matters. Services include pre-claim, litigation & mediation support, expert witness, reports, opinions, rebuttal expert, remote hearing and deposition attendance, discovery and document production assistance, training, analysis and assurance of fiduciary performance. Mr McConnell is one the earliest holders of the ACCREDITED INVESTMENT FIDUCIARY AUDITOR credential.

Over 35 Years’ experience, Independent Stock, Bond & Derivatives Market, Securities, Fiduciary, Banking, Insurance, Employment, Compensation & Valuation / Damages, Conflicts of Interest & 2008 Global Financial Crisis Expert

Investment Losses | Conflicts of Interest | Fiduciary Audits | Training | Assurance | Litigation Consultant | Expert Witness

Over 35 years extensive Stock market, Securities, Banking, Fiduciary & Broker Dealer Profit and Loss, Branch Manager & Financial Advisor (FA) Compensation Expert Experience in Investments, Suitability, Supervision, Fiduciary duty, Damages, AML, BSA, USA Patriot Act, SARs, Know your Customer & Broker Dealer Revenue, Expense, P&L, and Financial Advisor Compensation and Valuation of a broker dealer, branch office and or Series 7 registered representatives’ / stockbrokers’ book of business (clients)

Broker Dealer Revenue, Expense, Profitability expert, Branch Manager, Regional Manager, Product Manager, Financial Advisor or Stockbroker Compensation grid, Forgivable Loans, Sunset Retirement Plans, Training, Valuation & Employment

Areas of Expert or Consulting Assistance include:

- Corporate Governance, Board of Directors, ERISA Plan Sponsors and Investment committees

- Bankruptcy, Receivers

- ERISA, Taft Hartley, Public Employees Pension, Profit Sharing & 401k plans

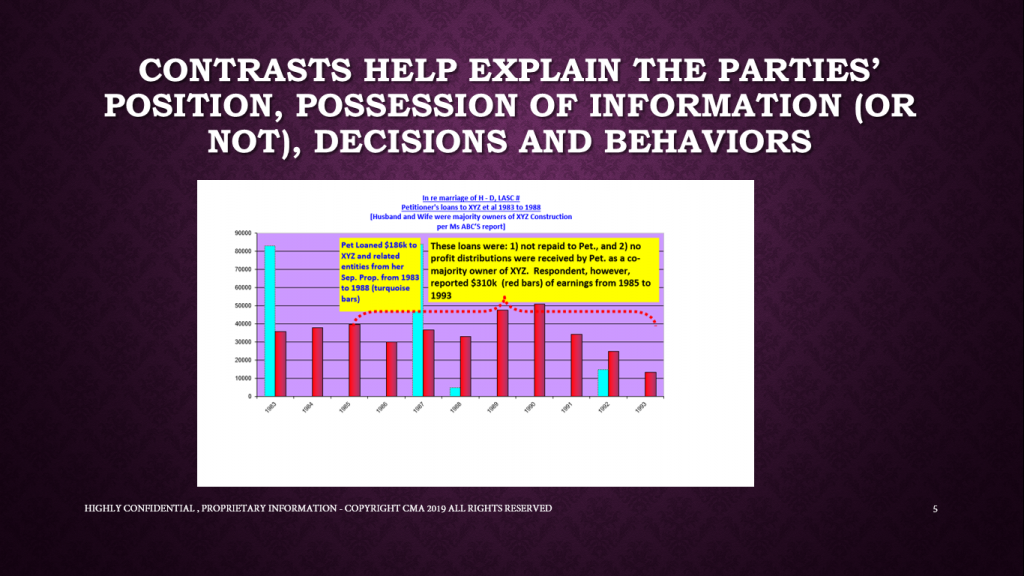

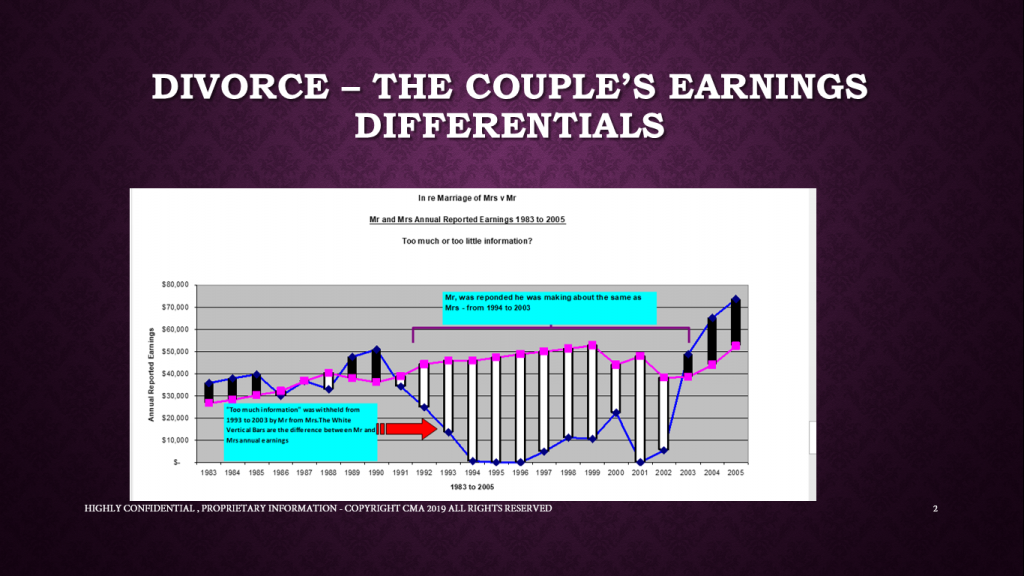

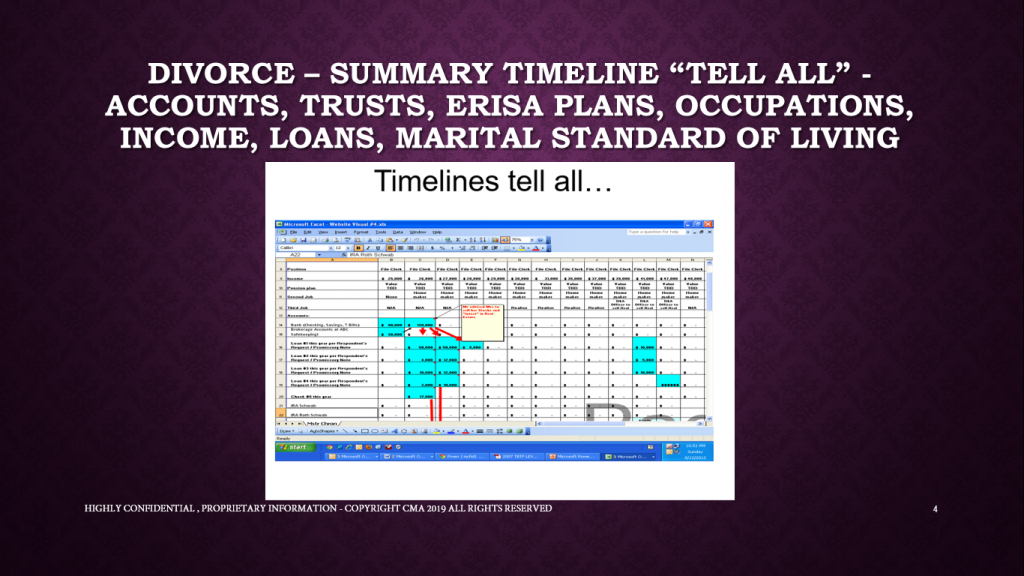

- Family Law, Divorce, QDRO’s; Divorce Fiduciary Audit™

- Federal, State & Regulatory Agency Investigations

- FINRA, AAA, JAMS, etc. Securities Arbitrations

- Non-Profits, Foundations & Endowments (aka Tax-exempt, Eleemosynary organizations)

- Trust & Estate, Probate, Surrogate

- IRA’s, SEPs, Conservator, Guardian, Custodial, 529 & HOA accounts

- MBS Securitizations, Foreclosure, Chain of Title, Real Estate Fiduciary Audit™

- Securities industry including RIA’s, IAR’s, Hedge funds and Private Equity – compliance, violations, custom, practice, policies, procedures and or rules, regulations and reporting

- Compensation, Employment, Valuation, Forgivable Loans, Retention Awards, Recruiting, Licensing, Registration, Training, Continuing Education, Titles, Promotions, Termination

- Financial Elder Abuse and Exploitation including covered, disabled persons

- 2008 Global Financial Crisis Expert

History

Over 35 years’ experience as expert and independent consultant including 19 years in the securities industry 17 years of which were in management at two major Wall St. broker-dealers in national, regional and branch management positions.

Global Financial Crisis (GFC) Expert

Mr McConnell’s GFC research began over 40 years ago. Mr McConnell exposes the man-made (not black swan) causes of the 2008 Global Financial Crisis (GFC) and connects them to policy, banking and broker-dealer choices before, during and after the zenith of fear, fraud, violations of investment suitability and fiduciary duty. Every securities account, mortgage and loan were directly or indirectly impacted by the GFC.

The roots of the 2008 GFC were not fixed. More pronounced market, media and participant assymetries are holding sway again of our financial (including but not limited to our money, securities lending, foreign currency, stock, bond, futures, options and derivatives) markets and real economy as we speak…

NOW IS A RED FLAG, IT IS IMPERATIVE FOR TRUSTEES AND FIDUCIARY ACCOUNT ADVISORS TAKE IMMEDIATE PRUDENT STEPS TO PROTECT TRUST ASSETS AND TRUST BENEFICIARIES

Annual FiduciaryALERTS™ since 2004 called out unusual risks along with prudent steps for Trustees & fiduciaries to protect trust assets & trust beneficiaries. Those who prudently followed those alerts were less exposed to the 2008 Global Financial Crisis.

Conflicts of Interest Expert

Conflicts of interest while largely wholly unavoidable can and do infect relationships at any time and require careful, prudent management to prevent infection and potential harms, for the benefit of all parties. With actual hands-on experience since 1983, including multi-thousands of financial advisors across millions of customer accounts Mr McConnell’s prophylactic consulting assessments (often within a compensation and incentives review or engagement) expose, address, monitor, manage and disclose existing and potential conflicts of interest for banks, broker-dealers, investment companies, investment advisors, private equity sponsors, insurance companies as providers of financial, investment and related advice and products and services and referrals (creating greater potential conflicts of interest) to internal and external third parties in compliance with exchange, ECN, dark pool, margin, legal, regulatory, state and national securities and insurance rules and regulations, internal national, regional, branch and financial advisor supervisory, compliance policies, procedures and manuals, terms of service (TOS), customer agreements and updates thereto. Case evaluations of claims or potential actions for investors, trustees, receivers and beneficiaries may surface current as well as historical conflicts of interest, disclosures, compliance, management, monitoring, supervision and or violations thereof in any relationship such as but not limited to: family limited partnerships, closely-held businesses and companies, family businesses, marital, extra-marital, contractual, extra-contractual, partnership, corporate, LLC, LLP, advisory, agent, trust, board of trustees, investment committees, ERISA plan sponsors, Taft-Hartley union pension plans, multi-employer pension plans, HOA’s, Investmenr clubs, Investment partneships including in fiduciary or non-fiduciary contexts.

Detailed History

Since 1983, Mr McConnell’s Wall St experiences include but are not limited to: supervision of the accounting and compensation areas of a major securities primary broker dealer’s national, regional and 450 branch office, 8,500 FA private client HNW wealth management group including every product and service. He modeled one of the first principal – protection 1940 Act equity investment products. Wrote the nationwide branch office Profit & Loss accounting manual and related policies and procedures applicable to domestic and foreign branches. Served on the firm’s nationwide and international real estate strategy executive committee, designed firm – wide business policies for customer commissions, fees, margin accounts, tiered margin rates (and cost of funds), stock loan securities lending (re-hypothecation), short credit rebates and money market mutual funds sweep, bank credit and debit cards, customer rewards points programs and insured bank deposit accounts. Analyzed profitability, costs, marketing and risks of wrap fee accounts, investment consulting services, fee – based managed accounts (proprietary, industry – first FA – managed, the first special share class mutual fund wrap fee advisory product and external third party managed), soft dollars, SEC 28 (e) and best execution. Developed compliance, surveillance and supervisory reports for customer account reviews including realized and paper unrealized gains and losses, turnover, churning and money laundering, AML flags. Each position or project included extensive interaction with Information Technology IT areas and leading external third party consulting firms establishing an extensive breadth and depth of experience linking IT, firm data, internal firm profit, budget targets, sales management, back office operations, compliance, surveillance, supervision, sales practices and training and customer account performance.

Securities and insurance licenses previously held included Series 3, 4, 7, 9, 63 and 65; California Life Insurance, Annuities and Long term care insurance licenses.

Mr McConnell brings a truly unique and deep background to a limited number of engagements: 1) advanced fiduciary AIFA training, supplemented with annual continuing education each year since 2003, 2) over 19 years of actual hands-on major Wall Street broker dealer experience in every product and service and at every level of a broker dealer (firm national headquarters level, regional office, branch office to individual financial advisors) including detailed, extensive competitve analysis of national and regional securities broker dealers and the broader financial services industry such as payment cards, lending and insurance products and external, third party vendors, 3) BA in Economics with Accounting option, 4) Master of Business Administration, MBA and 5) successfully passed the CPA (Certified Public Accountant) exam which collectively span the breadth and probe and can reveal the innermost dynamics, data collection, duties and responsibilities of a bank, credit union, financial services firm, investment adviser or securities broker dealer (or otherwise regulated and or un-regulated individual or entity) or any other legal entity connected to the financial system (such as a payments processing provider or money transfer service) from the CEO, Board of Directors, Officers of the Corporation level, related corporate governance & fiduciary duties, headquarters level through a regional office, product manager, branch office to stockbroker’s or sales trader (or a group or team’s) sales solicitation, recommendations, disclosures, monitoring and customer’s account statement performance. Frequently, identification of external third parties may be warranted for compliance, fiduciary and other industry-related reviews.

Mr McConnell’s evaluations may include relevant current and historical (dating to the 1970’s) statutory, federal and state regulatory (such as but not limited to: SEC, NYSE, FINRA, NASD, NFA, CFTC, FRB, FDIC, OCC) industry rules, regulations and current and historical industry custom and practice plus federal, state and or industry records investigations.

Mr McConnell has assisted legal counsel with high profile, multi-party (such as professional athletes, actors, producers, writers, creative artists, brands, VIP’s or celebrity) as well as extended, decades-old, multi-generation, multi-party complex litigation and arbitration matters involving family trusts, closely-held family businesses, ERISA retirement & union member Taft-Hartley pension benefit plans, life insurance, annuities, non-profit or foundation entities, foreign accounts and partnerships. These matters draw upon his academic background, training and 35 plus years of experience identifying compliance with legal entity planning, selection, registration and renewals, legal entity / corporate board of directors’ governance, partnership or LLC organization, officer and fiduciary duties, entity formation, insurance, loans, mortgages, re-financings, accounting, financial reporting, Sarbanes – Oxley, tax & DOL filings, bank and brokerage account, know your customer, BSA, anti-money laundering (AML), USA Patriot Act, financial crimes (FinCen), elder and disabled financial abuse, identity theft, unauthorized account and device access, online deposits, payments and transfers, electronic and digital hacking including cell phone, tablet, laptop and network intrusion, falsified or substituted documents and forgery issues.

Compensation, Valuation & Employment areas of expertise include:

Mr McConnell wrote the Financial Advisor (FA) compensation plan and branch manager bonus programs for a major Wall St broker dealer. Since 1985 he supervised the nationwide branch and regional office accounting department, and supervised the branch P&L accounting and monthly variance reports for FA gross production payouts and overall compensation, branch manager and regional manager incentive bonus calculations.

He consults and provides expert testimony and rebuttal testimony and unique time series, parties, account level, attention-grabbing charts, tables, graphs and reports and large format demonstrative evidence on securities, futures/commodities, registered investment adviser, financial planning, banking, custodian, securities industry recruiting, forgivable loans, training, sales practices, compensation, compliance and disclosures expert including FINRA, (NASD), FINRA Form U-4, FINRA Form U-5, CRD, SEC, Forms ADV parts I, II and III, SIFMA, SIA, BMA, NYSE, CFTC, DTCC for traders, stockbrokers, financial planners, RIA’s (registered investment advisers), advisory firms, introducing brokers, clearing firms, money managers, wealth managers, portfolio managers, traders, branch managers, complex managers, regional managers, internal product coordinators, external third party product wholesalers, custodians and prime brokers.

Financial Advisor Forgivable Loans – further actual hands-on experience includes the nationwide supervision of FA “Forgivable loans,” FA “retention” bonus also known as “FA Retention awards” since the first forgivable loans were issued in 1982, FA Promissory notes, FA Recruiting, FA Training, FA Sunset or Retirement fees and or commission-sharing plans, FA Book Transition or Retirement plans, Registered sales assistants, Reg S-P, branch manager account distribution of a stockbroker’s book of customers. Actual hands-on experience extends to broker-dealer, region, branch and FA – level accounting, tax analysis, supervision, loan design and branch, regional and firm-wide management of Forgivable Loans, Promissory notes, Taxable income, AFR and or insurance thereon since 1983 for two major Wall St securities broker/dealers.

Mr McConnell is expert on all elements of Branch manager and regional manager compensation including salaries, bonus criteria and incentives, bonus payments, cash, deferred, stock and stock options and other components. Mr McConnell supervised and designed branch manager and regional manager salary, bonus, other awards and emoluments paid by cash, deferred compensation, restricted stock and option awards tied to branch, product, compliance and broker/dealer and regional annual revenue budget, profitability and other goals.

He also is expert and consults and testifies on branch office, product or service, business unit (P&L) valuation and analysis, valuation of a broker’s book, AUM, branch office, complex and or regional office P&L (revenue and expense) components including allocation of headquarters office and regional office overhead expenses.

He is further expert providing consulting and expert testimony and reports on securities, investment and life, long term care insurance and annuities product marketing, distribution; sales force and market penetration studies for every product and service offered by a “full service” also known as “wirehouse” or “discount” broker-dealer.

Mr McConnell has over 35 years of deep and extensive experience in evaluating all elements of market segment and product analysis at firm, region, branch, FA or investment adviser levels including in response to federal and state agencies including the FTC and US Congressional anti-trust inquiries.

Mr McConnell’s professional library consists of hundreds of older publications including textbooks, industry trade publications and magazines (which may or may not be available online) which have and can prove extremely helpful in certain decades-old cases.

Approved Continuing Legal Education seminar provider through 2018, California State Bar Association, “Investment Fiduciary Responsibilities for Trustees and Fiduciaries”

For more information contact@fiduciaryexpert.com or (310) 943 – 6509

Copyright Chris McConnell & Associates 2003-2020 All rights reserved