Before 2008 a real, real estate market did not exist. Americans are not dumb, but due to misleading information about the real estate market they made predictably bad mortgage decisions.

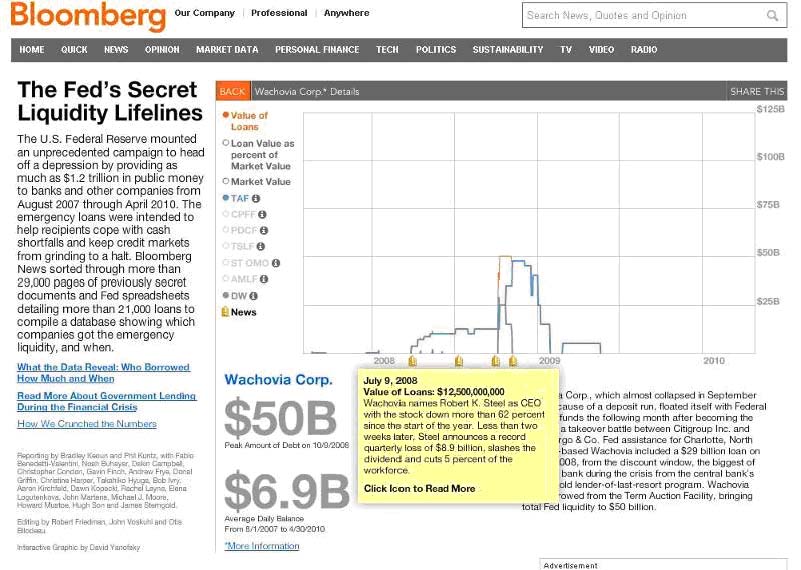

Banks and only banks control/led leverage in two ways. The first took place during loan origination, requiring a down payment or no down payment; 20% down and zero down loans allowed, 5x to 100x leverage on the equity of a home, respectively. The second element of leverage occurred (per the FDIC hidden, concealed) upon certain banks’ balance sheets. Certain banks could and did use their own computer models to value their mortgage investments. I estimated 2,000 times leverage or more (upon the ultimate collateral, i.e. equity cushion in home prices) was common at certain banks before the financial crisis. Certain banks hid their mortgage bets through or in SIVs (Structured Investment Vehicles), from 2003 to 2008 over $12T of MBS were issued. Who held and invested in them and who and how were they valued?

FiduciaryALERT™ 2011

Any mortgage borrower: in foreclosure, eviction, or default, FINRA securities arbitration and or securities fraud litigation attorney may find FiduciaryALERT™ 2011 useful. As of now, this information has not been reported in the main stream media connected in this fashion.

Before 2008 potential violations of suitability and or breach of fiduciary duty appear. Also potential RICO-like acts may link insurance companies, securities lenders, asset managers, hedge funds, certain counter-parties with, and may have enabled certain banks, broker dealers, mortgage issuers, MBS trust sponsors and or their agents to trot out more and more mortgages RMBS, CDO’s to unsuspecting mortgage borrowers and investors

PREVIOUS FiduciaryALERT’s HAVE PROVED USEFUL

May 2006, “What do Elvis and Johnny and Fiduciary Duty have in common? A light hearted, timely reminder; as at the time both Elvis’ and Johnny Carson’s estates evaluated and decided to sell some of their real estate holdings.

July 2008’s was “Denial of Twin-flation™ or inaction is not a prudent investment strategy.” Twin-flation™ described the opposite pressures on the food and energy markets and the labor, real estate and financial services / banking industry and the US dollar including a list of steps by which to evaluate your investment process in detail. The Dow Jones Industrial average was over 11,000; in a few months it plummeted by almost 5,000 points.

If you would like assistance on steps you can and should take to carry out your fiduciary duty concerning your mortgage and or investment fees, costs and expenses or a party to litigation involving securities RMBS, CDS, CDS on CDO, RMBS contact us at info@fiduciaryexpert.com

The purpose of each FiduciaryALERT™ is to draw trustee’s attention to pressing issues and to review their asset allocation decisions; importantly each ALERT is not a recommendation to buy, sell or hold particular investments; rather to deliberate and document their process; in sum, demonstrate prudence in action.

FiduciaryALERT™, 2,000x (times) Leverage™ and McFid, BFD expert since 2003™ are pending registered trademarks of Chris McConnell & Associates

Initial Courtesy Consultations

(310) 943 – 6509

© Chris McConnell & Associates 2011 to 2013 All rights reserved worldwide