The SEC commissioners conducted a brief 55 minute hearing on April 28, 2004 that set the stage for the global financial crisis (GFC) which began to unfold in early 2007 and reached full boil in September 2008.

The SEC commissioners conducted a brief 55 minute hearing on April 28, 2004 that set the stage for the global financial crisis (GFC) which began to unfold in early 2007 and reached full boil in September 2008.

As far as I’m aware, only five companies applied for SEC permission to become CSE’s (Consolidated Supervised Entities). Those five were Bear Stearns, Goldman Sachs, Lehman Brothers, Merrill Lynch and Morgan Stanley. The CSE program was terminated by the SEC on September 26, 2008 but only after all five CSE’s ceased to exist whether by merger (Bear Stearns was merged into JP Morgan in March 2008, Merrill Lynch merged into BankAmerica in September 2008), bankruptcy (Lehman Bros.) or switching charters to bank holding companies (supervised by the Federal Reserve regulatory scheme) in the case of Goldman and Morgan Stanley. The charter switch enabled (among other benefits) Goldman Sachs and Morgan Stanley to borrow billions from the Fed’s discount window. (And at the same time and dating back to July 2007, Goldman was embroiled in a multi-billion dollar collateral call dispute with AIG, later resolved by the payout of close to $15B in total to Goldman Sachs (not Goldman Sachs International, the actual counterparty to AIGFPG) via the New York Federal Reserve – supervised Maiden Lane LLC entities.)

The CSE program’s hallmark and attraction was only the “largest, most sophisticated investment banks” could become so (they had to maintain $5 Billion in net capital) and apply for permission to use “ANC or alternative net capital.” In other words the CSE’s (and the SIBHC’s at some the largest commercial banks in New York) could use their own computer models to determine their capital requirements. The computer models were subject to pre-approval and ongoing review; which according the SEC Inspector General report at least in the case of Bear Stearns happened less than expected and nearly one third of the CSE’s did not even file required document with the SEC. Also according the the SEC Inspector General report, other CSE firms’ documents that were filed with the SEC were not adequately reviewed by the SEC.

The CSE program’s hallmark and attraction was only the “largest, most sophisticated investment banks” could become so (they had to maintain $5 Billion in net capital) and apply for permission to use “ANC or alternative net capital.” In other words the CSE’s (and the SIBHC’s at some the largest commercial banks in New York) could use their own computer models to determine their capital requirements. The computer models were subject to pre-approval and ongoing review; which according the SEC Inspector General report at least in the case of Bear Stearns happened less than expected and nearly one third of the CSE’s did not even file required document with the SEC. Also according the the SEC Inspector General report, other CSE firms’ documents that were filed with the SEC were not adequately reviewed by the SEC.

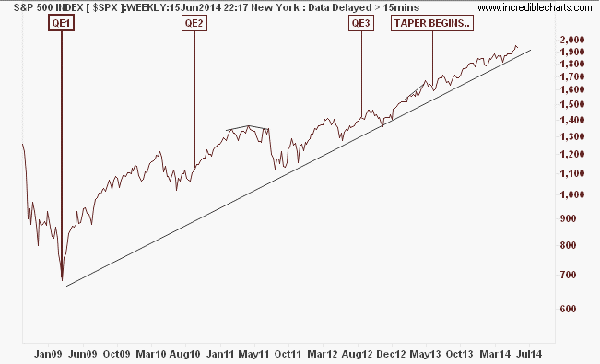

This event ten years ago today, was a seminal event which led to and caused the global financial crisis. In total at the end of 2007, the CSE’s and SIBHC’s were over leveraged to the tune of $16 Trillion worth of assets, exposures and commitments according to an FCIC document which I refer to as page 13. In comparison, US GDP was in the $14 Trillion range or so at the time. Leverage is another way of saying assets owned or controlled but not paid for. Leverage is also (to the degree here) disintermediation; the exact opposite of why banks exist in the first place; to intermediate (that’s an action verb), meaning facilitate access to and capital formation for the REST of the economy.

These arrangements and the ways in which $16 Trillion built up from 2004, in the darkness of the Shadow Banking system in the US explains much of what we saw before 2008 and explains the need for all of the extraordinary support (i.e. bailouts), favorable accounting treatment. Still today April 2016 the Federal Reserve has over $4 Trillion balance sheet composed of Agency MBS (mortgage – backed securities) and US Treasury bonds.

For more information support@fiduciaryexpert.com or (310) 943-6509

Copyright Chris McConnell & Associates 2014-2016 All rights reserved