Taxonomically the sudden surge in demand for toilet paper is likely to bear similar hallmarks to the incipient spike in litigation claims for breach of fiduciary duty. These claims are likely to appear in: partner, business, employment and compensation disputes, family and charitable trust matters, ERISA pension and profit sharing, Taft-Hartley union, or multi-employer plans, divorce / marital dissolution, corporate bankruptcy, corporate governance including non-profit, foundation and endowment (tax-exempt) organizations, intellectual property and professional malpractice. FINRA arbitration claims are expected to surge dramatically; where we have substantial experience over 35 years in thousands of cases.

While we all are familiar with most of the applications for toilet paper knowing when, who, how and where and perhaps most importantly any account exceptions and or limitations with respect to damages models to apply the applicable prudent fiduciary standard of care or other standards of care may befuddle even the most seasoned of practitioners; especially when there may be multiple accounts, institutions, account agreements, unequal parties or potential parties, time periods, varying market conditions, fluctuating asset valuations, changes in financial, investment, insurance, real estate, legal, tax and other advisors, and or varying fiduciary or other standards of care among the potential parties and potential damages models consistent with the specific types of breach involved.

A US retiree told us he lost more in the stock markt in the last two weeks, than he ever made in a year while he was working (he made about $250k) and that was LAST week. Today the market shows down another 9%.

Chris McConnell, AIFA

Fiduciary duty entails the pursuit of any and all claims; boards, trustees, investment committees, beneficiaries including in certain situations; IRA and Rollover IRA accounts are unlikely to be silent while significant losses and risks mount rather they may be seeking to hold responsible parties personally accountable. Having a prudent process in place can help mitigate and even remediate certain market or extra-market declines, however, the luxury of time is fast expiring.

The risk of coronavirus and risks in the fiduciary areas (especially since September 17, 2019) are clearly at elevated levels; in both situations, preparation, protections, diligence, and vigilance are of utmost importance.

In the fiduciary (and securities, employment, compensation) space we are highly experienced calling the ball and strike zones, if you find yourself unsure or would like an independent assessment of a potential claim, risk or exposure, you’re welcome to contact us for immediate assistance. Time is of the essence, in addition to claims or risks you may be aware of, we often identify new potential claims, exposures, weaknesses and or the means and sources of recovery.

Many of our restaurant marketing clients can instantly spot when a dish has a garnish such as a sprig of lemongrass missing or out of place. Welcome to the expert who can spot when a fiduciary or other applicable standard of care may be “out of place” or worse.

A global financial crisis redux?

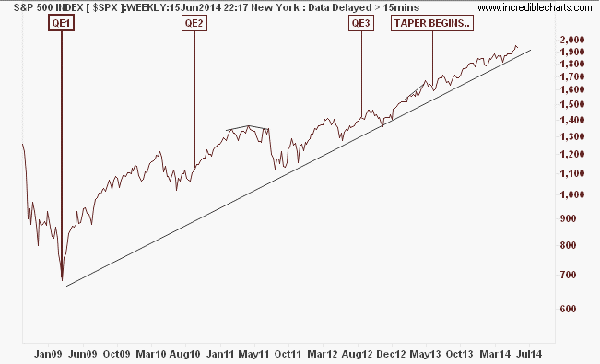

Some may recall the 2008 global financial crisis timeline; Bear Stearns crumbled and was taken over by JP Morgan over St Patrick’s day weekend. 2008 was a US presidential election year. The Fed was already at work bailing out the primary dealers having already started, we later learned, in December 2007 and granting billions of balance sheet intracompany, affiliate FRB Rule 23-a regulatory relief to the largest banks in August 2007. Mr Bernanke addressed the NY Economic Club a week after the stock market peak in October 2007 and assured us that everything was “ok”. About a year later, “the cost of the education of Mr Bernanke” passed about a trillion dollars later to surpass twenty – nine trillion dollars.

In case it is not abundantly clear now, not later is the time to evaluate and or present potential claims and or mitigate exposures; in less than six months the US Federal Reserve has loaned a cumulative $9 trillion (today’s Sunday, March 15, 2020 emergency Fed actions up that to over $11 trillion, slashed Fed Funds and the Discount interest rates to near zero, extended loan term dates out to 90 days, and leave the door open to further accommodations) to the 24 primary dealers mind you not since measures to stem coronavirus but about 180 days ago, since September 17, 2019. The market’s reaction? Dow Jones futures plummeted 5%. Each business day, the Fed has loaned tens of billions to the 24 primary dealers without disclosing why the markets can’t or won’t lend to these institutions, what purpose the money is for, to whom or amounts. The Fed has even refused for over a month now to answer questions posed in a letter from several US senators. Don’t be surprised if you see major financial and other institutions, governments or agencies disappear behind “institutional distancing” curtains or payments or other types of “holidays” (recall FDR’s “1933 bank holiday”). See any similarities? Unexpected delays, moratoriums and or restrictions placed on certain and or perhaps all types of actions would not surprise us.

We strongly support as public health care officials have requested you practice your best personal health hygiene to avoid the coronavirus aka Covid-19 and we here, strongly recommend you implement your very best fiduciary duty hygiene as well, sooner than later. Don’t allow potential claims to turn into toilet paper.

THIS IS NOT A DRILL

UPDATES: Wednesday, March 18, 2020

Not 1, not 2, not 3, not 4 but a baker’s dozen whammy hits the country…

There’s NO ESCAPE…

Escape, there’s no more “escape” many popular (but not all) means of escape from work, finances, reality, depression, anxiety, stress and most other burdens (known and unknown) are gone, off-limits, canceled for now including cruises, concerts, movies, “going out”, live sports, just hanging out with friends at the local coffee shop, etc. Whether we realize it or not, many are experiencing withdrawal symptoms such as “life without March Madness, the NBA, Major League Soccer, Champions League, EPL, NHL, MLB’s Spring training”. Making matters worse, is we are left with a tv, tablet, cell phone “news channel/official update (state tv-like) focus”. There are no movies to GO to, no bars and restaurants to GO to, no vacations to GO on, an entire panoply of escape routes are cut off, literally cut off due to widespread mandatory shelter in place requirements. Which brings to mind, why with crude oil prices (WTI) down to about $23 or so per barrel (BBL) why prices at the pump are still over $3.00 to over $4.00 at some gas stations? If we weren’t dealing primarily with CoronaVirus I’m pretty sure that would be front-page news. On the flip side, that may be good news to companies in online entertainment, gaming, media, pharmacy, marijuana, BWS (Beer wine and spirits) and tobacco spaces. Thankfully musicians are entertaining us as they always have with live-streamed shows. (For those into musictech, I designed several new performance, content and licensing concepts for interested musicians, rights holders and music business/industry/investor folks; hit me at the contact info below.)

CoronaVirus – US health care policy messaging and miscues at best; now seem to be playing better but still catch – up ball

Wasn’t $29 Trillion enough?

RepoVirus – the Fed and in particular mainstream media, has not covered this highly concerning (now over $11 Trillion) banking story since September 17, 2019. When, after the major banks caused the widespread carnage on Main Street, during the 2008 global financial crisis, the last major US financial panic, and global recession, anything that touches the “electric lines” of money being extended TO the banks should have been front-page news and or leading stories on the nightly news, but it is still and was not.

Return of the ghost of 2008 GFC past; understandably millions of people are not “over” the memory, pains, stress or perhaps may be still suffering from the repercussions of the last financial crisis and millions more understand that the “whole” story has been sanitized. About 1.9 Million homes (about 3.5% of all mortgages or about 1 in 30) were still underwater, meaning the mortgage was more than the value of the house amounting to $283 Billion as of the 4Q2019, or an average of close to $150,000 per underwater mortgage. (Btw Fannie Mae’s HIRO program may help certain high (over 97%) loan to value (LTV) mortgagees after a similar program from Freddie Mac expired.)

Lack of confidence (reliability) in “official messaging” on CoronaVirus, financial markets, the economy, Main street in particular and how millions of average Americans and seniors will even be able to pay their bills or purchase necessities and groceries.

Trillions of dollars of massive lack of liquidity in major stocks, selling pressure on stocks just seems to keep forcing them down blowing through price supports, such as today’s minus 1,338 points (after being off over 2,000 during the session, Wednesday, March 18, 2020) on the Dow Jones Industrial Index, closing at 19,898

Has HFT (high-frequency trading, aka proprietary trading) by the major banks and brokerage firms taken a holiday? Why? And why now?

CECL (Current Expected Credit Losses) implementation and the elevated risks to corporate balance sheets and earnings. This highly significant, material topic formally known as the FASB’s Accounting Standards Codification (ASC) 326 (issued June 2016, effective over three years later December 2019 for 2020 financial statement presentation, although the FDIC states it may be adopted prior to that date) receives scant coverage in media outlets. Further, media reports on the potential impact on issuers’ (SEC registrants’) credit ratings (which would appear to skew towards the negative side) appear muted.

Concerns over possible suspensions or limitations on withdrawals from certain bank savings or checking or certificate accounts, potential bank holidays? Will banks actually run out of cash/money, and perhaps use a potential bank holiday to conceal their true condition? Why the concern? In the last several weeks, major US corporations were reportedly fully drawing down on their bank lines.

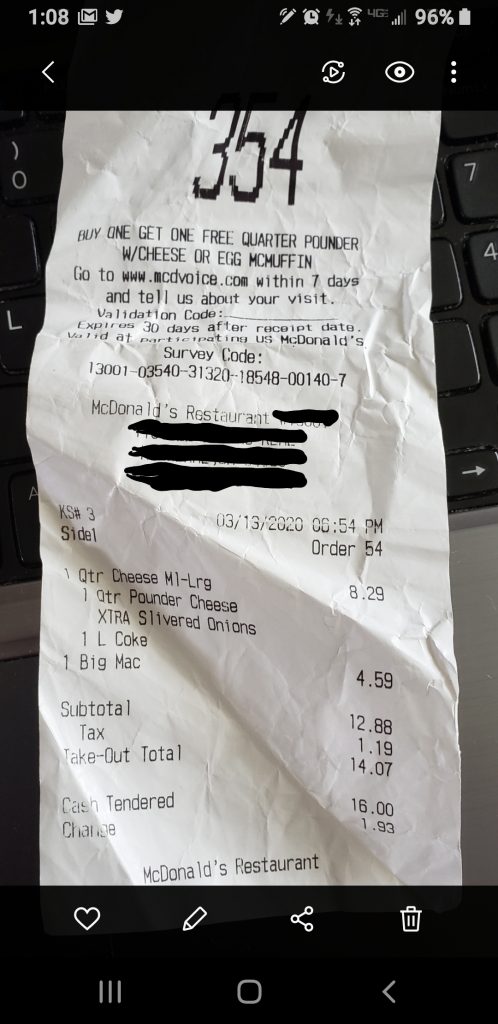

Was it the “canary in the coal mine,” we ordered a #2 meal and a Big Mac, they said sorry we’re out of ketchup and large size drink cups this past Friday, March 13 at 6 pm.

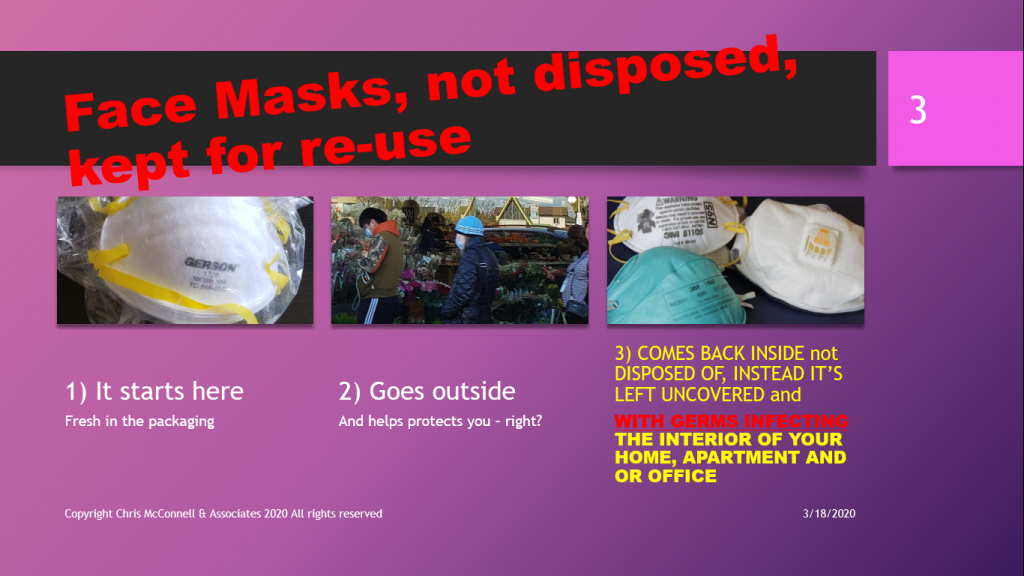

The CoronaVirus is a global health emergency so we depart from our lane and offer several policy considerations; Why has the flu shot not been discussed in connection with the CoronaVirus? Questions such as: is / was the flu shot effective or not in preventing symptoms, contracting and or mitigating CoronaVirus? Why or why not? How about a New Capital Gains Tax Exempt Accounts, Face Mask (re-use) Risk, FevaDot or TempaDot, and Long Hair. And a once in a generation comprehensive political opportunity regarding explanations of and for repeated bank bailouts.

Face masks here and back again – a silent killer? Understanding potential Face Mask (Re-use) Risks

Face mask users may be unintentionally importing Coronavirus back into their homes, apartments and offices via used face masks by planning to re-use and or actually re-using face masks. Face Mask Re-use Risk seems to me, is a very real, unappreciated risk that users may tend to re-use (and not dispose, let alone properly dispose of the) face masks, so when they get back home or to the office, they remove it, with the germs on it, they place it down in their home or office, where germs can survive and perhaps spread on the counter or shelf where it is placed in their house or office or apartment for days perhaps survive even longer since the face mask is made of absorbent material (i.e. compared to a less porous counter or shelf surface). I may be 100% incorrect here; so please correct me; however, it appears policymakers and public health officials may have overlooked this potential CoronaVirus spread risk.

FevaDot™ or TempaDot™ is a new novel HIGH VISIBILITY temperature readout worn on the forehead. It’s a plastic, nickel-sized, thermal dot. How it works? It displays green if you’re WNTL (within normal temperature limits), it shows yellow or red it’s above NTL. Maintains social distancing and reducs or eliminates the need for others to get a close to scan the forehead.

Long(er) hair, since hair protects, is there perhaps, I repeat maybe a flip side, posing a greater risk of exposure to Coronavirus? More hair would seem to potentially collect more germs. Individuals touch their hair frequently then occasionally their face area, it’s just a question, maybe not a dumb one.

Politicians have a once in a generation opportunity to remove the curtain around the current bank bailouts. The last time (2008 Global Financial Crisis) bank bailouts topped $29 Trillion, millions of homes (throwing out millions of today’s millennials) were foreclosed and millions of Americans lost their jobs, and many of them lost their health care. Now, since September 17, 2019 the Fed, the NY Fed in particular, has provided overnight to longer term collateralized loans to many of the same banks exceeding $10 Trillion (we haven’t precisely counted the most recent loan/relief announcements) but it appears to exceed $11 Trillion in cumulative bank loans in the last six months. Some may ask how or why would this be needed or possible since the stock market hit a record high less than five weeks ago with the Dow closing at 29,551 on February 12 (that was about 10,000 points ago) while the Fed and NYFRB have refused to disclose which banks are receiving the loans, why and for what purposes among other concerns). Yesterday Mr Mnuchin floated the prospect of a $1,000 check for every? Americans (amounting to around a $1 Trillion. That’s helpful, but results in a preference of over 10 to 1 in favor of the largest, most sophisticated financial institutions. How would that be justified on a personal, human, look ALL of your constituents straight in the eye level? It can’t and it shouldn’t EVER happen again unless boards, managements, shareholders and creditors take the first hits; as they would under free, fair and open markets aka “capitalism.”. Let us not forget, the Fed BRUTALLY devastated some may say punished and or led to the potential demise of thousands of senior and other savers, (those whose life savings could not prudently bear the risks of the stock or bond markets) many millions of senior citizens each and every day since it cut interest rates to near-zero starting prior to the last financial crisis.

Real people, that means most, not just the “suit-class”, want solutions, not empty promises of apple pie, but more importantly, they want answers and explanations. While on Wall St, it used to be said that cash is king, we are now in an age where that may no longer be as true, since transparency will eventually be king, especially as concerns repeated multi-trillion dollar bank bailouts. Of course, I could be completely wrong and incorrect on all of this, let’s hope so.

Millennials – besides being at potentially greater risk of exposure to contracting and spreading (asymptomatically) CoronaVirus, what lessons, mistakes, better or perhaps correct moves will they see taken or repeated by their governments’ policymakers at federal, state and local levels? The same applies to their schools, colleges and markets; in addition to getting hit by a baseball bat leveled upon millions in foreclosed homes meted out by the 2008 Global Financial Crisis. Will millennials take note of or just keep cruising by Senator Mitch McConnell’s (R-KY) aphorism “there’s no education in the second kick of a mule” I suppose it may all depend on what or who is the kick or the mule right?

Latinos have been and are the fastest growing segment of the population and work force, and pay the fastest-growing amounts into the Social Security and Medicare trust funds and will continue to fund Social Security and Medicare benefits for today’s baby boom retirees for decades to come. Will they actually receive full or just partial benefits in the future? There’s a very good chance they may or may not, perceptions may have a significant impact on housing, education, benefits, health care, capital markets, immigration and elections, in particular, going forward.

CHRISTMAS IN MARCH FOR INVESTORS?

New Capital Gains Account Holidays – the administration might consider and propose a new type(s) of stock purchase account (capital gains and dividend “growth tax-exempt accounts”) for individuals such as a 100% forever guaranteed capital gains tax exemption (up to certain amounts such as $100,000 or $250,000 or more depending on the number of years held) for stock purchases for example, made this week, ending March 31 or so (subject to a 5 to 10 year holding period). Along with this measure, foreign investors could also perhaps be eligible to benefit from an unlimited number of family accounts exempt from future capital gains taxes) offered by brokerage firms and banks including online banks. Also special capital gains tax exemptions for investments in stock or companies involved in coronavirus treatment research or support companies. The administration may also wish to offer deferred capital gains tax treatment on existing / current holdings such as no capital gains taxes or reduced capital gains taxes subject to progressive and or elongated holding periods.

Summary note: we are in uncharted times, uncharted times require us to go out of our lane and put forth uncharted ideas or questions, that is the spirit in which this post is offered. Any and all mistakes and or typos are the 100% result of trying to help and thinking out loud 🙂

For immediate assistance contact@fiduciaryexpert.com or

(310) 943-6509

Fiduciary, Securities, Compensation, Employment, Compliance, Payments & Valuation / Damages Expert since 2003

Digital Marketing, Advertising, Promotion, Online Ordering Expert since 2010

Copyright Chris McConnell & Associates 2020 All rights reserved