Gold Silver Platinum Precious Metals Coins Futures Commodities Margin Trading

Individual and institutional investors often approach Gold, Silver, Platinum, Palladium or Rare Earth minerals for many of the same reasons and with similar expectations but wind up with vastly different results and sometimes dramatic losses. What happens in the metals markets begins with analyzing major players, margin and information. Some gold investors do not however see Gold or bullion solely as an investment but as money (or specie) see the link to the historic 1836 Specie Circular and Specie Payment Resumption Act from 1875.

Individual and institutional investors often approach Gold, Silver, Platinum, Palladium or Rare Earth minerals for many of the same reasons and with similar expectations but wind up with vastly different results and sometimes dramatic losses. What happens in the metals markets begins with analyzing major players, margin and information. Some gold investors do not however see Gold or bullion solely as an investment but as money (or specie) see the link to the historic 1836 Specie Circular and Specie Payment Resumption Act from 1875.

Trading gold coins, silver or gold bullion encouraged through certain dealers’ promises of easy profits, low risk has gained popularity and may fall outside the investor protection, regulatory framework of the SEC, FINRA, CFTC or NFA. Gold and precious metals investors are often drawn to gold as a store of value, as advertised on dealers’ websites and television commercials.

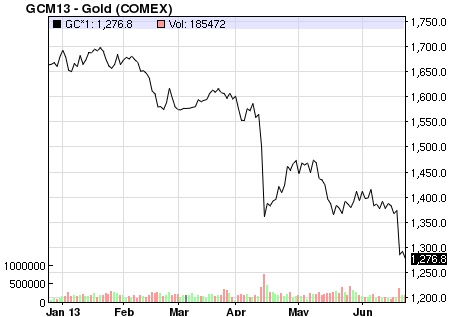

However, when customers are drawn into trading gold on margin; steep rapid losses may occur due to sell outs over gold, silver, platinum coin or bullion price whipsaws or volatility. Gold or metals trading losses may exceed the percentage decline in the price of the underlying metal, for instance according to a Reuters report Gold Spot price is down over 25% this year and 22.8% this quarter (and down about 35% from the all time high of $1,921 per ounce set in September 2011) however investors’ trading losses may far exceed those percentages due to a number of factors including trading gold, gold coins and silver in leveraged margin or loan accounts.

Tax traps pose another hurdle for investors and dealers to consider before trading gold coins.

When you buy coins, you may owe sales tax, depending on which state you buy in. But selling triggers, because the IRS deems precious metals collectibles, a special capital gains rate to any profits on their sale. Gains on coins held less than a year are treated as short-term capital gains and taxed at your ordinary income tax rate, while those held for a year or more are taxed at the capital gains rate of 28% for long-term collectibles, not the lower 15% rate for other capital gains.

More traps – Gold, silver bullion and or collectible coins can hedge against inflation, but there are other issues, often carry premiums over 10% over the value of their gold to cover the cost of fabrication and commissions paid for distribution. Certain coins will have a lot of ground to make up before buyers can break even or later be sold for a gain. Then there’s the added cost and inconvenience of storage and or insurance.

When or if customers or investors experience losses it’s common that disputes go to arbitration, an example follows:

…subject to the terms of the Federal Arbitration Act and shall be submitted to final and binding arbitration before JAMS [Judicial Arbitration and Mediation Services], or its successor, in Orange County, California, in accordance with the laws of the State of California for agreements made in and to be performed in California…

The arbitration provisions called for the selection of an arbitrator under JAMS rules, except that the arbitrator must be a retired California judge (either state or federal), and either party could require a panel of three arbitrators. The costs of arbitration were to be split evenly, unless one party requested a three-arbitrator panel, in which case that party was required to pay all arbitrator fees. The provisions allowed for an appeal of a single arbitrator’s decision through an appellate process conducted by JAMS (three-arbitrator decisions were final).

Investors who experienced precious metals account value whipsaws, significant short term trading losses may have only themselves to blame but in some cases especially in certain accounts like family trust accounts (see this Seeking Alpha article for IRA and 401k Rollover Gold, Coins issues) representatives and dealers may have responsibility for enabling or contributing to those losses. Chief among them are sell outs, ineffective stop loss orders, commissions, margin account interest charges, loan fees, storage or handling and insurance fees. And the answer to the all important question – what, when and why did I change investment objectives?

Kiplinger reported prudent advice when you are interested in selling gold jewelry.