[Note: the entertainment segment of this post is at the end for 13-3 = 10 fans. All the usual disclaimers apply. This post is based upon what’s been reported in public but it seems to me that better communication from certain parties could and should have prevented that which happened to Silicon Valley Bank (SVB) last week. Information is not financial, legal nor any other form of advice; DYOR and or seek your own independent, personally tailored advice.]

First here’s the link to SVB’s website as of last week courtesy of the Wayback Machine https://web.archive.org/web/20230310162208/https:/www.svb.com/

Let’s give a little background of the facts that have been reported by various media. Below is a rough timeline to help understand some of the series and sequence of events at and around SVB

ANATOMY OF SVB’S MELTDOWN, A BFD? (Breach of fiduciary duty)

~TIMELINE, SEQUENCE, BACKGROUND AND QUESTIONS

- 2020 to 2021 SVB takes on tens of billions of deposits from red hot, Covid-era startups’ funding rounds

- Over 80% of deposits are over the FDIC insured limit of $250k

- Interest rates are near zero or LIRP (low interest rate period) and have been for almost 10 years

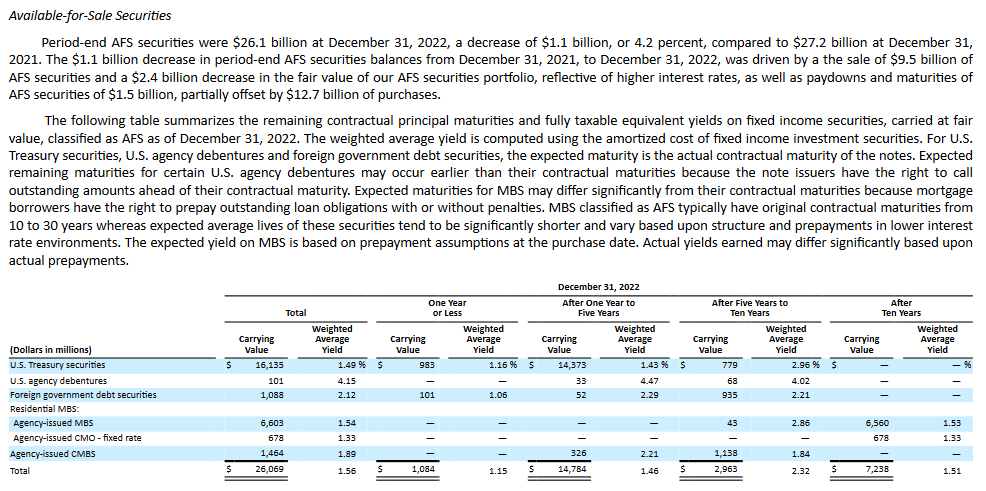

- SVB invests billions of it in UST and MBS short to medium duration securities

- SVB execs and registered lobbyists push for relaxed Dodd Frank for banks under $250B-it’s approved, SVB is under that bar of course

- SVB raises over $8B in additional capital across equity, preferred and fixed income offerings during 2021 to 2022

- 2022 FOMC raises rates continuously to over 4% Fed Funds

- VC funding of startups takes a pause, startups’ exit via IPO markets (and via SPAQs) take a pause, startup companies draw down cash – cash burn

- SVB CRO steps down April 2022

- SVB borrows $15B from FHLB San Francisco branch as of Dec 31, 2022

- SVB reports $15B paper AOCI loss on its HTM & AFS portfolios as of Dec 31, 2022

- SVB names a new CRO January 2023

- FOMC raises rates again in January 2023 another 25 bps, push Fed Funds range to 4.50% to 4.75%, two year US Treasury bill hits 5.10%

- SVB execs sell significant portions of their stock in the days and weeks in advance of last week

- SVB issues their 2022 annual report dated Feb 23, 2023

- ~A dozen Wall St stock analysts rate SVB stock buy or overweight (there is only one analyst with a sell rating); the consensus SVB EPS is in the mid $4 range for 1Q23 eps, due April 2023

- Bond ratings agencies rate SVB bonds in the single A/triple BBB area with a stable outlook (per SVB website)

- SVB bankers entertain portfolio clients on the ski slopes in Utah at Snowbird

- FDIC calls a meeting with bankers March 6, 2023 during which it is stated banks are sitting on $620B of unrealized losses on their AFS & HTM portfolios (as of Dec 31, 2022)

- Peter Theil, Founders Fund advises portfolio clients to remove excess deposits from SVB, early last week

- SVB sells part of its bond portfolio, takes a $1.8B loss on sale

- SVB CEO talks to clients and customers of the bank on conference calls

- Moody’s’ lowers the rating on SVB to junk

- SVB tries to raise ~$2B in equity and a convertible preferred during a “quiet period” but despite a $500M commitment from General Atlantic the raise fails

- Last Thursday, Bloomberg interviews a guest with extensive connections to Silicon Valley tech startup scene. The anchor and guest comments are bereft of mention of #10, #13, #20, #21, #23 and #24 and seem bewildered as to why SVB stock is down about 60% on the day at that point including after-hours trading at ~5:30 PM EDT

- Last Friday, SVB stock trading is halted; uncharacteristically the CA DFS and FDIC announce during trading hours SVB is being taken over and placed into FDIC receivership, the FDIC has typically historically announced and conducted these moves after the market close on a Friday

- The whole time apparently SVB fails to actively manage its bond portfolio duration and or interest rate risk, asset-liability match, cash flow match, deposit growth stalls, deposit withdrawals continue apace

- A question – did SVB consult and or rely upon a registered investment entity regarding its bond portfolio? What if any alternatives were presented, considered in addition to taking a multibillion dollar loss upon sale?

- And this – what if any, communications took place between SVB and the various regulators during 2022 and up to last week, March 2023?

- Another question – what if any securities advisors or investment bankers consulted and or relied upon for the nature, size and timing of the capital raise?

- What if any 10K or 8K disclosures were or should have been made by SVB in connection with the above events?

A former US Treasury secretary and White House economic advisor was on Bloomberg TV Wednesday with Romaine Bostick. In part, he outlined we may need to rethink how market value (mark-to-market) of financial institutions’ bond and securities portfolios are reported and or regulated.

Why? In addition, a former FDIC manager commented on Bloomberg yesterday and I’m paraphrasing here: that the FDIC is or appears hostile to technology advancements, seemingly failed to patch some holes during examinations last year, and is decades behind today’s digital money flow technology.

What is the four letter word that may be part of a solution? AOCI* but AOCI could mean “About our crappy investments” but it’s rather a quintessential, technical accounting term meaning “Accumulated Other Comprehensive Income.”

* AOCI is a big deal, clocking in at a negative $620B for US banks per the FDIC, meaning that amount was or would be a loss if certain member banks were to sell their securities and realize the loss. Today this number is likely much higher, possibly approaching $750B to $1T since it is over 75 days old now, as of year-end 2022 and the FOMC hiked another 25 basis points in January and as spreads have changed.

My AOCI solution proposal consists of three measures. Step one is to take the current portion of AOCI, currently generally reported on the balance sheet, remove the wiggle room in the current reporting regime and show it straight up on the “P&L” quarterly earnings statement. Alongside that is a second solution to include AOCI in the required regulatory capital haircut calculation regardless of bank “asset” size, thus for all categories of regulated financial institutions not just the top few categories.

SVB was, it’s been reported, to have lobbied for exclusion of this metric from their required capital, and also from annual bank stress tests such as CCAR, onto a two year cycle and got it passed under the previous administration. Since we are on the topic of stress tests, solution three would require all financial institutions (no exceptions) be required to undergo annual stress CCAR and other relevant tests including real-life yield curves plus worst case what-if scenarios.

Market participants are all familiar with each of these concepts, there is little to no learning curve, leading to the desired behavior change increasing safety and soundness.

*AOCI is accumulated other comprehensive income. A vestige of the GFC when the SEC, PCAOB adopted a kinder and gentler approach to this critical issue of mark to market losses. It was and is a low standard enjoyed (and exploited) by some market participants such as insurance companies which were and are allowed to record changes in securities portfolios values to flow mostly through the balance sheet instead of the P&L (we don’t intend to get in a long form discussion here of the applicable reporting requirements and or wiggle room).

Balance sheets are “the hiding place”. Subsequent to the GFC, during the DLIRP (decade of low interest rate policy period) and still today, issuers’ balance sheets often fail to garner the headlines nor the level of scrutiny they warrant thus escaping many investors, creditors, ratings agencies, media, and or regulatory eyes. SVB and others are a case in point due to the historically rapid increases in short term rates by the FOMC during 2022 and 2023 “going from zero to 475 (bps) in seven months” comment by Christopher Ailman’s CalSTRS CIO comments recently on Bloomberg.

We should note that SVB is not alone in having reported a multi-billion negative (paper or unrealized loss in their securities portfolio value) AOCI line item as of December 31, 2022. Indeed AOCI paper losses as of the same date at some of the largest banks in the country include: – $108 billion, -$41 billion, – $24 billion and – $36 billion in paper or as yet unrecognized losses at several of the largest, most sophisticated financial institutions in the country without naming names.

What about the FHLB playing the role here of the potential penultimate lender of last resort to SVB? The FHLB likely was aware SVB raised over $8 billion from several different capital raises across equity, preferred and fixed income during 2021 and 2022 right? Why in 2022 would SVB secure another $15 billion in loans from the FHLB which would make for a total of $23 billion? It could be helpful to know the representations made by SVB around the $15 billion extension of credit from the FHLB which to be fair, SVB allegedly repaid shortly before it was taken over by the California DFS and the FDIC last weekend.

REG FD – a potential risk of violation

My general sense about what went so wrong at SVB is based on my research, public filings and news reports is that the proximate cause of SVB’s spiral was likely the alleged conference call between the SVB CEO Becker and customers which occurred middle of last week. Why? It was unusual, if not extraordinary for a bank CEO to host a call with customers, in that context; during an offering, during a material financial event the sale of the AFS portfolio, on the heels of the Silvergate demise a couple days earlier, and the reported use of the phrases “would be a challenge” and “stay calm” regarding potential deposits being withdrawn. This seems to be clearly body, if not actual language that the overall market would also need to and want to know; potentially covered communications under Reg FD (Fair Disclosure).

Were there potential conflicts of interest or quid pro quo?

Secondly, the extent, nature and history reported around the “leaving millions or billions of uninsured deposits” at SVB does not make sense to me. Why? Modern corporate cash management has evolved significantly over the past forty years or so. Based upon reports that SVB had $150B of uninsured deposits and banked let’s say 4,000 startups at a 4% yield (to the startups) comes in at around $1.5 million a year in interest or dividend income before tax. That’s not peanuts, it suggests that an individual startup would not simply nor en masse (that looks like a pattern) leave it on the table. In the real world, it means they could if needed in the future, hire five maybe up to ten engineers or other staff. So that points the answer to the question in other directions or agendas as to what may have been afoot at SVB, SVB’s executives and perhaps board, the venture firms and their portfolio companies (the startups), not forgetting to include the personal and or charitable, philanthropic interests which possibly may have been at play. A large part of the explanation is likely to be found in the other investments made or not by and at SVB.

Our financial banking system: Safety and Soundness

sound·ness – /ˈsoun(d)nəs/ noun, noun: soundness, 1. the state of being in good condition; robustness; 2. the quality of being based on valid reason or good judgment.

If assuming we agree that this is an acceptable definition of soundness juxtaposed against and within the context of the well- known Albert Einstein aphorism: that the definition of insanity is doing the same thing over and over again and expecting different results. Then it’s not a stretch to feel that our financial and in particular the banking system we have therefore is not sound, it is unsound. Why?

Why should we in 2023, be dealing with the same problem that was pointed out by a prominent witness to the FCIC over 10 years ago? During the lead up to the 2008 GFC that we had a mark-to-market (MTM) problem. Goldman Sachs’ CEO at the time, Lloyd Blankfein in his prepared and live testimony stated in so many words that we (meaning some or nearly all of the former five CSE’s Consolidated Supervised Entities a 2004 SEC construct terminated on September 26, 2008) had a mark-to-market problem (or could’ve done better). Failures in mark-to-market was one of the primary (and indispensable) causes of the GFC. Some will remember other meanings of MTM’s at the time such as mark-to-mystery and mark-to model. We have previously covered the SEC’s CSE program here (see box below) back in 2014 on the tenth anniversary of the creation of the SEC’s CSE program enabling voluntary application for adoption of the alternative (allowing a proprietary) net capital calculation at the behest of the largest, most sophisticated financial institutions in the country in conjunction with the President’s Working Group on Financial Markets.

Furthermore as we observed here nine years ago, this problem of mismatched cash flows or duration dates all the way back to the financial panics of 1857, 1873 and 1884. In fact, the Clearing House Association investigations committee at the time, determined three times in a row that call money; typically, at the time, from the interior banks posed a higher risk (since it was hotter and more likely to flee out, leading to a bank run) than other types of deposits. This was succinctly pointed out in Moody’s Annual of 1907 (not a typo) 116 years ago and as we wrote here in 2014

What is the cost of financial firefighting?

While the book Firefighting by Bernanke, Geithner and Paulson came out several years ago, one loss then and still now which will never be recovered and which is hardly if ever reported or analyzed is the human cost and productivity costs of financial firefighting. What is financial firefighting?

Financial firefighting is the human hours that are wasted at the drop of a hat, nothing-else-matters mindsets take over, then-current promising opportunities are jettisoned and may never see the light of day or be evaluated again, massive amounts of human intellectual capital are devoted to putting out the proverbial fire and flying embers which suddenly whirl around threatening to ignite other parts and participants in the financial and banking system. It doesn’t however just stop there – there is no magic fire break line. I would add that in general, peoples’ overall concerns manifest into questions of trust not limited to: in the government, “in the system”, fairness, winners and losers, another bailout for monied and or elites’ interests, in elected and appointed representatives, agencies and officials, rules and regulations, banks and business and seeps into the web of fear and other negative emotions fanned by most of if not all the media.

The costs of time in human hours starts with the highest level of federal government and agencies, creditors and lenders worldwide, Wall Street broker dealers and banks, securities and futures clearinghouses, the venture capital funds and their principals, private equity, all financial services businesses, all the way to the tens of millions of banking customers, all businesses, nonprofits, foundations and endowment accounts plus all retirement and pension benefit funds and 401k, 403b and 457 accounts and those workers and their families who expected to get a paycheck from the thousands of startups that banked with SVB. When you start to tally up the stress, fear and time it takes to calm the markets the number of human hours and lost productivity are staggering.

In the last week or so these hours had to be immediately and urgently diverted “to put out the fire” and to take certain actions by federal agencies (very late on Sunday but in time for the Monday opening. Everyone saw the emergency steps: guarantees of uninsured deposits and discount window collateral acceptance that were initiated.) The cause of the fire was what amounts to basic, rookie mistakes on the part of SVB management. It’s likely in the tens of billions of dollars of time wasted that will never be recovered. SVB, it appears, using a motorcycle analogy, going over the speed limit, doing 80 mph and they didn’t have or use or know to use the brakes; a when not if, accident waiting to happen. An accident that was if anyone bothered to look was known and knowable in advance and it’s not restricted to SVB. As we stated above, it’s potentially a problem at four or five of the largest financial institutions in the country and that’s using 75 day old data from the end of the year so the size of the problem is likely worse now.

A subtle but ever-present part of financial firefighting (and the costs thereof) is not limited to the above dramatic rescue scenes; it’s the Fed. Why? The Fed’s presence, in a leading role, has overly complicated the calculus and distorted the economy and financial markets globally since 2007 when it granted exemptions to certain large banks for SFT’s with their affiliate banks. Which, under regulation 23-A were prohibited above a certain threshold. Most if not all the affiliate banks were chartered in the state of Utah. However, the exemption approvals did not copy the Utah DFS leading to a potential information gap. SFT’s are secured financing transactions related to RMBS and similar derivatives. Why? As background, AIG was quoted as saying “there’s no two way market” (for RMBS) in 2007. Be reminded Bear Stearns’ two RMBS-related hedge funds cratered in the spring of 2007. And the collateral call dispute over CDS on RMBS between AIG and Goldman Sachs began in July 2007. And on July 11, 2007 an AIG trader said to another AIG trader on an internal phone call “people are trying to hide marks” (on RMBS) according to the transcript.

A financial firefighting cost survey

Perhaps something for researchers to think about and maybe set up a social media survey: 1) When and how did you hear about the banking failure at SVB? 2) What was your gut reaction? List the typical reactions- fear, worry, unhappy, disappointed, Alfred E Newman “what me worry”, etc.? 3) How many days did you worry or have these feelings? 4) What would you estimate was or is the number of hours you were distracted or worried by or had to “work” on this banking issue? 5) Did you lose any sleep over these issues? 6) Add any more comments you’d like here

Today still market participants are of the mentality they don’t, when it comes right down to it, believe the platitudinous statements that “the banking crisis is over” or “there is no banking crisis” or similar. For example: one bank is trading down sharply after hours despite a $30B deposit rescue from other major banks, $164B was accessed thru the discount window, nearly $9B was withdrawn from a prime money market fund, and a prominent foreign bank’s stock is now trading under $2 per share nor the typical, tiresome efforts to jawbone down the storm from certain nothing-to-see-here types while participants are of the mindset of just waiting for the next shoe to drop and trading and moving deposits accordingly into safer haven assets.

We would be remiss if we didn’t at least briefly point out the obvious aftermath of SVB’s takeover. The behavioral finance dynamics are pretty obvious; it’s either fight or flight and it’s abundantly clear that capital flight is rapidly taking place out of certain financial institutions in volume and into government bonds (and or to money market mutual funds largely invested in same) which does not auger well for future economic productivity or growth here in the US and globally

Why put AOCI in the sunshine?

The market is and depositors are thirsting for clear, unvarnished, known and in fact knowable information. What is the AOCI exposure? Give that to the market and things will likely settle down, if as regulators have verbalized, the system is indeed strong. Remove the discount window backstop because it won’t be needed. Which reminds me of a business practice I use on occasions such as this: I am from the state of New Jersey whose nickname is the Garden State, when it comes to business though I find it’s helpful on occasion, to act like I’m also from the state of Missouri whose nickname is “the Show Me” state. Thus regulators and perhaps issuers should simply show us and come clean on what their exposures and AOCI are pronto. Extraordinary times like these call for something that’s doable and it’s not really a heavy lift: disclose the institution’s AOCI exposure.

The ask is not overly burdensome by any stretch. Why? It’s already known, financial institutions and banks in particular know and track their investment portfolios daily, many if not all of the largest track and monitor these metrics in real time on a minute by minute basis during market hours and afterwards. Thus they already have the data – it does not need to be created anew.

While it may be a little unpalatable to certain issuers and their managements, these three AOCI -related steps are direct, simple to understand and easy to implement with perhaps a brief phase-in period. And meaningfully contribute to what’s needed most now which is added (not the same and not less and not a huge pile of new regulations but) palpable openness and transparency. Thus investors, creditors, counterparties, customers, other stakeholders and regulators and insurance carriers will feel that they “know and have a better sense of what’s going on rather than have to guess or speculate” and easily and readily see how well or not a financial institution is managing its duration risk and other plain vanilla banking risks with a very visible mark-to-market of their bonds and other securities holdings. Bank managers, executives and boards will no longer have “a place to hide” these potential risks on the balance sheet any longer ending the well documented, dangerous information asymmetry.

In the case of SVB it reported a negative AOCI as of the fourth quarter of 2022 in the neighborhood of negative $15 billion. This represented roughly a 15% decline in the value of its securities portfolio spread across its HTM and AFS securities portfolios.

The disclosures made by SVP seem to have been in order and absent potential fraud or other malfeasance by any party/ies connected, the investment, creditor, depositor community and the credit ratings agencies again missed the ball. Credit ratings agencies were very late in the game to downgrade SVB debt and then just a few days later the entire US banking system. That any depositors, such as private equity or venture-backed entities should know that they should not leave millions of dollars of uninsured deposits (maybe earning little to no interest or dividends) at any financial institution not just SVB, is likely not a prudent course of business and may expose individual officers and directors to claims for breach of fiduciary duty among other potential claims.

There are hundreds of suitable, institutional, and retail liquid high quality, ultra-high quality, ultra-short duration US Treasury and agency-backed money market funds. Substantial portions of these tens of billions or more of uninsured deposits typically could and should have been invested with daily liquidity. We have over 40 years of direct, hands-on experience working with and establishing business policies and procedures such cash management accounts for all customer segments, products and check writing, deposit credit, sweep and associated rewards and card privileges policies dating back to the early 1980s.

A never-ending rinse and repeat “Banking crisis” news cycle

Not to put too fine a point on it but for the past ten days I would say that it feels like and may well be that every hour of coverage and reporting on Bloomberg TV involves some aspect or element of SVB and “the banking crisis” and what the Fed or other regulators and market participants are saying, doing or what they could or might do or not (on a constant never ending rinse and repeat cycle) to the neglect of many other important economic or business and other news stories. Obviously this creates information gaps that again will never be recovered because the time has passed

Last we’ll leave off here for now with the entertainment segment with a clip from YouTube Fresh Prince’s take on Sir Tom Jones’ classic hit, It’s not unusual

Reach us here contact@fiduciaryexpert.com or (310) 943-6509 accepts calls and texts

Copyright Chris McConnell & Associates 2023 All rights reserved

Copyright Chris McConnell & Associates 2023 All rights reserved