Successor Trustees’ RED Flag: Who will be left holding the bag? Hold off accepting any trustee or new board appointment until fiduciary expert due diligence checks out

The good tidings of the holidays and beginning of the 2019 new year bring with it fervent hopes for things to improve, get better and this: for switches in trustees and new board of directors appointments. Let me make this very important point right here: these all entail a personal and ultimately unavoidable fiduciary duty, responsibility and liability.

However, it’s harder to imagine a more potentially fraught-filled and risky role than a trustee; except for those invited or asked to take over as a successor trustee which is a potential hornet’s nest.

Concern #1 points out the obvious but as of now, nebulous, unclear and largely unfulfilled role of responsibility for successor trustee assurance. Concern #2 raises the question, who is qualified and can expertly assist a potential successor trustee or fiduicary

Throughout my 35 years of experience, time and time again, what’s proved helpful is the ability to stay informed and top of issues from both near and afar. Being able to lend my expertise and a fresh set of eyes from afar has proved indispensable in countless high-stakes situations and helped many clients pursue and or avoid what was unseen and or misunderstood by advisers being a little too close to the action, in other words, not able to see the forest for the trees and or outright conflicted, nerligent and or biased.

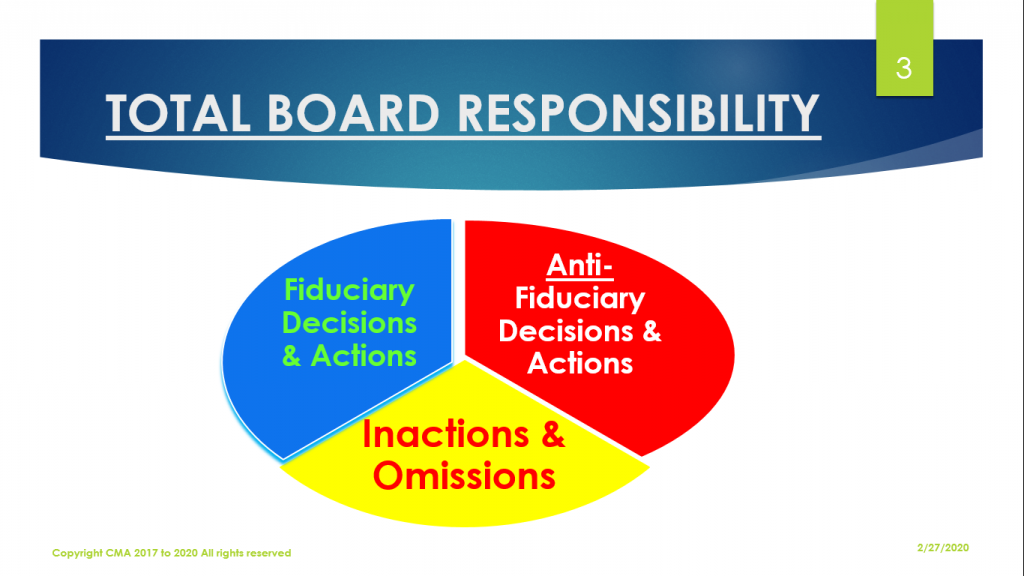

While trustees, board members or ERISA or non-profit, foundation or endowment investment committee members of any stripe are fiduciaries and personally responsible for a wide variety and increasingly microscopically forensically scrutinized potential breaches of trust, fiduciary duty, conflicts of interest and or self – dealing plus the acts or omissions of others. Successor trustees are in a bit of a situation not unlike squirrels on a wheel. Why? Continuing the squirrel theme, in a

It’s strongly suggested potential successor trustees review any and all

A recent headline-grabbing money laundering case from the UK highlights so-called “professional enablers” in this excerpt:

Hajiyev’s fortune — believed by law enforcement officials to have once exceeded $100 million — has become the focus of a groundbreaking money-laundering case. The U.K.’s National Crime Agency obtained court orders in 2018 freezing some of his assets and requiring Zamira to explain the origins of the family’s wealth. The authorities have said they hope the case will be a blueprint for curbing the estimated 100 billion pounds ($128 billion) in dirty money that worms its way into Britain every year, often from economically deprived countries. One of the keys to doing that is cracking down on so-called professional enablers, who are required under U.K. regulations to carry out know-your-customer checks of clients and report suspicious activity to the authorities. A politically connected chairman of a state-owned bank in a notoriously corrupt country, whose spending far outstripped his earnings, should have raised red flags with those hired to manage his finances. One look at the International Bank of Azerbaijan’s annual reports and prospectuses would have shown that compensation for its five-member management board, plus senior executives, totaled about $1 million a year during Hajiyev’s tenure in the 2010s. In 2018, a British judge said it was “very unlikely” that Hajiyev “would have generated sufficient income” to fund even one of his many properties.

We recently posted a suggestion for Brokerage and Trust accounts to consider budgeting for commissions, fee and expenses to help guide, plan for and control same. For new or potential successor trustees, budgets for the above as well as budgets for any and all potential line items of cash inflows and outflows may help better understand, monitor and control and attend to any and all fiduciary duties.

PROPHYLACTIC ASSURANCE SERVICE FOR SUCCESSOR TRUSTEES

We help you and your legal counsel answer and get comfortable – not guess, suppose or assume – with the most important questions such as: what do I and should I really know about this trust, non-profit, charity, foundation or endowment that I should know before I agree to become a board member, trustee or successor trustee? Absence of an evidenced-based comfort level points to declining the invitation to become a board member or trustee and avoiding potential headaches down the road. The same set of prophylactic assurance services are available and apply to new CEO’s, C-level or senior-level officers. Be headache-free and contact us to get started.

For Professional Athletes:

Have you, a teammate, coach, friend or colleague had a close call or been approached by a slick, you might say less-than-upfront operator(s) trying to ride your brand name or get you involved in an investment “ground floor opportunity or great deal” or serve / use your name as a charity supporter or even serve as a trustee or perhaps you may personally even serve in a trustee or fiduciary duty – exposed role? Did you read, understand and agree to EVERY word in contracts, agreements or trusts before you signed?

We treat all of our inquires, referrals and engagements with the utmost, strict confidentiality. As for us being on social media, we are not, we know the limits of our time and expertise and it does not include social media, we haven’t built our business in that fashion, we don’t and never have been active on social media. While many of our clients are active on it, for now we prefer to avoid it. Among other things, that explains why there are no social media links on this site.

We are uniquely positioned having seen many hundreds of pitfalls in over 35 years of professional experience, prior to that as well during our college years to help expediently assist potential and or already committed new Successor trustees and legal counsel conduct such a review with a prophylactic Fiduciary Forensic Audit and or FACE Audit™ among other forensic tracing related needs which may arise in the course of the audit or investigation.

For more information please reach us at:

contact@fiduciaryexpert.com or (310) 943 – 6509

Fiduciary, Securities, Compensation, Employment, Compliance, Payments & Valuation / Damages Expert since 2003

Digital Marketing, Advertising, Promotion, Online Ordering Expert since 2010

Copyright Chris McConnell & Associates 2004 to 2019 All rights reserved

Categories: Conflicts of Interest RuleFACE AuditFiduciary Account Commissions Expenses AuditFiduciary Account ManagementFiduciary duty expertPrudent Investment ManagementTrustee duties

Tags: Brokerage BudgetFiduciary Account Compliance Auditfiduciary account protectionFiduciary AuditSuccessor TrusteesSuccessor Trustees LiabilityTrustee SurchargeTrustees Standard of care