Perry Mason, was a late 1950’s and 1960’s hit television show, Raymond Burr played the role of Perry Mason, Esq. We begin in the courtroom.

Perry Mason, was a late 1950’s and 1960’s hit television show, Raymond Burr played the role of Perry Mason, Esq. We begin in the courtroom.

Mr Mason: “Where were you on the morning of August 9, 2003?”

The witness: “On the Jersey Shore, (Mr Mason speaks: “go on”) it was a slightly overcast Saturday morning. You know the perfect kind to read the New York Times business section, with a regular coffee at George’s Diner on F Street.”

Mr Mason: “Was there anyone with you?”

Witness: “No”

Mr Mason: “So you have no witness, is that correct”

Witness: “Yes, except there was this article, kinda caught my eye. See my breakfast was a little slow coming out, as I turned to page five, bam, it just hit me.”

Mr Mason: “What hit you? A car, a train, a bus, a frying pan, a bug – be more specific!”

Witness: “No, it was a RED FLAG, a defining moment – you might say”

Mr Mason: “No further questions your honor.”

The following is a true story. It’s a story about a very important announcement, buried inside on page five (as opposed to the first page), of the New York Times business section, on a Saturday (the weekend, the day perhaps after a late Friday night) and in August (if nothing else, the mental vacation month). This announcement was SO important, that any inquiry or investigation into AIG’s sudden decision, reversing 30 straight years of never suffering a loss on this particular kind of insurance, would quite likely have prevented the 2008 financial crisis.

Ten years ago AIG raised a major flashing red flag ahead of the 2008 financial crisis; few paid attention. On August 9, 2003, ten years ago to the day, The New York Times headline read forebodingly “To insurers, a long free ride is looking risky” AIG wanted out from insuring some of the largest Wall St brokerage firms.

If you don’t have time to read the full story an excerpt or two follows:

“It has been a wonderful business for insurers: tens of million of dollars in premiums collected over 30 years, and not a single claim paid. So why, suddenly, do the insurers want no part of it? The business is writing insurance that American brokerage houses buy to protect clients’ accounts against the possibility that the brokerage firms will go bankrupt and that the clients’ assets will go missing.

Later in the article – perhaps the second most important part:

“In the surety bond field, coverage is generally extended only after careful study of financial statements and other signs of business health. Losses are rare, and losses on an Enron scale were unheard-of. As the insurers regained their composure, they began cutting back on all surety bond business — anything that even slightly resembled the Enron deals.”

The most important was a 4 word quote from AIG’s spokesman:

The insurers have not trimmed coverage or raised prices; they have simply gotten out. ”It’s too much exposure,” said Joe Norton, a spokesman for the American International Group.

Any inquiry by Wall St’s regulators NASD, SEC or the NYSE? Radio silence. Five years after the 2008 financial crisis and the major fires have been temporarily controlled, but not all.

If you had been paying your car insurance to the same insurance company for 30 years – then they suddenly said – even though we never paid out a claim for you – you’re NOW too risky – we are not renewing your coverage, how would you feel?

If you had been paying your car insurance to the same insurance company for 30 years – then they suddenly said – even though we never paid out a claim for you – you’re NOW too risky – we are not renewing your coverage, how would you feel?

Over a dozen of the largest Wall St brokerage houses formed a self-insurance company called CAPCO Excess, several others found limited replacement, but often capped coverage through Lloyd’s of London.

I may not have gotten to page 5 in the Business section that Saturday except my breakfast took awhile to get to my table. It would appear that few others read or understood the RED flag.

It’s unclear whether CAPCO Excess had sufficient capital to cover certain sponsor’s insolvency in 2008 as should have happened, a few weeks later the government bailout for these broker dealers saved them from Lehman’s fate. Ironically, it was the non-regulated AIG Financial Products Group that exposed AIG (the parent insurance company) perhaps to the very risks the surety unit wisely passed on 5 years earlier.

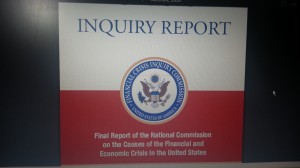

The FCIC (Financial Crisis Inquiry Commission) spent a year and interviewed 700 witnesses, held 19 days of hearings, reviewed millions of pages of documents and issued a 545 page report. Similarly the Senate Permanent Subcommittee on Investigations did not investigate this defining moment.

The FCIC (Financial Crisis Inquiry Commission) spent a year and interviewed 700 witnesses, held 19 days of hearings, reviewed millions of pages of documents and issued a 545 page report. Similarly the Senate Permanent Subcommittee on Investigations did not investigate this defining moment.

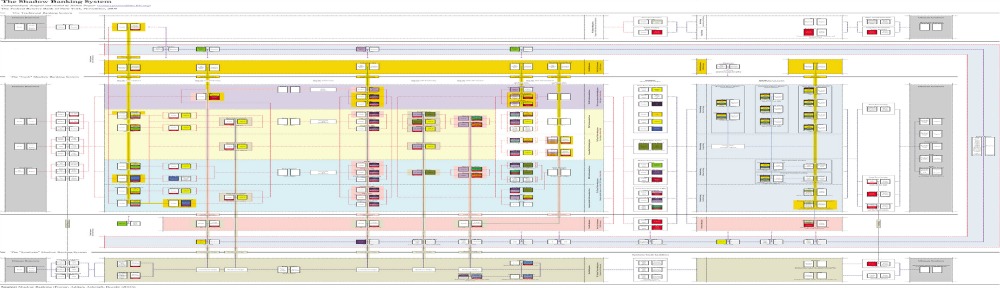

AIG FPG insured the ill-fated credit default swaps on multi-sector CDO’s with only 16 counter parties. AIG (parent) was on the hook due to CDS CSA (Credit default swap credit support annex) provisions. The US Treasury and Federal Reserve Board bailed out AIG with $182B. However, the surety insurer of certain entities should have been looked to first; as it was the first place to look for coverage for them in the event a counter party like AIG failed.

This critical 2003 news story prompted annual FiduciaryALERTs™ from 2004 to 2011.

This critical 2003 news story prompted annual FiduciaryALERTs™ from 2004 to 2011.

Each FiduciaryALERT™ repeatedly and directly pointed out economic problems and concerns including transparency, record valuations of real estate and bonds, and leverage (both explicit and implicit), fiduciary challenges and potential solutions.

FiduciaryALERT™ 2013

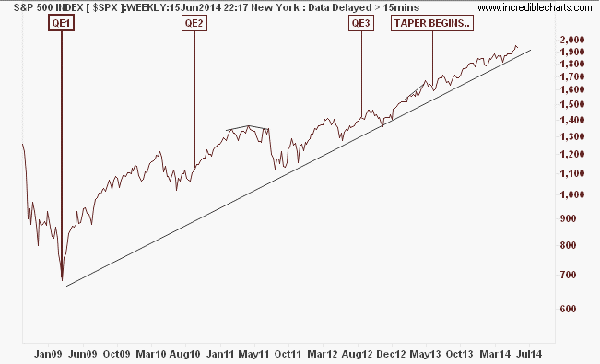

Today, because past problems have not been resolved in normal markets, fiduciaries face an unprecedented dilemma. Now, more than ever before, for the first time in the last century, there is an increasing mismatch in current US dollar – based assets and non-dollar driven claims upon same by beneficiaries in the future.

Fiduciaries including trustees of private trusts are cautioned to be very deliberate, consult independent advisers and thoroughly document the required prudent process.

Beneficiaries are likely to ask to see the fiduciary’s file, in particular, what was reviewed and decided in the summer of 2013. As soon another divisive US debt ceiling debate may flare up. Around the same time, a new head of the Fed will be announced requiring eventual Senate approval. The new chairman of the Federal Reserve looks to inherit a set of assets valued well over $3 Trillion.

We repeat the FiduciaryALERT™ issued mid July 2008 red flag excerpt which applies more strongly today>

“Perhaps a useful insight may be gleaned by asking ourselves, will asset risk and return performance from the past 20 years more closely resemble or differ markedly over the next 20? Of one thing I’m quite sure; some beneficiaries (and litigation counsel) are going to ask.”

Waiting for a cyber hero to magically appear on our doorsteps, rip open his shirt and spill out the “answers” is not recommended!

Waiting for a cyber hero to magically appear on our doorsteps, rip open his shirt and spill out the “answers” is not recommended!

In this “extra-market” economy, as no time ever before, every investment factor and assumption is at greater risk, including the proxy for the risk – free rate and the US Dollar remaining as the world’s reserve currency.

Trust, but verify with McFideo™

Get FACTS™

Fiduciary Account Compliance Testing Solutions

Elite Protocols * Fiduciary Account Excellence

Exclusively for families of

Professional Athletes, Creative Artists, Entrepreneurs, Executives and Ultra HNW & Non – profits, Foundations and Endowments

McFideo™

Protects your

People | Pets | Portfolio

McFideo™ is a pending registered copyright, trademark and patent of Chris McConnell & Associates

Copyright Chris McConnell & Associates 2009 to 2013 All rights reserved

Elite Advanced Protocols < Fiduciary Account Security Protection > Proactive, Not reactive