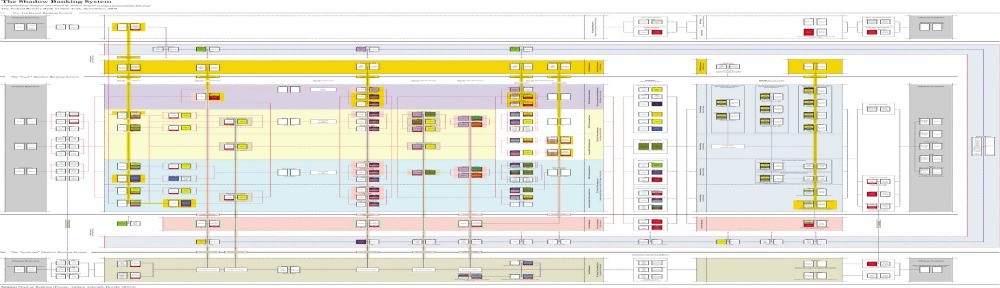

The picture is a diagram of the US Shadow Banking System produced by the New York Fed in 2009/10. It is important to note, a handful of the largest, most sophisticated American banks, largely in the Federal Reserve district east of the Hudson created and inflated the Shadow Banking system. Layers two and three contained thousands of subsidiaries also referred to as off-balance sheet entities, special purpose vehicles, (technically called qualified variable interest entities). These layers held or issued trillions worth of derivatives (RMBS, CDS, ABCP for example) and derivatives (including synthetic derivatives) upon those derivatives (CDO’s, CDS on CDO’s). The size of the shadow banking system grew larger than US annual GDP. US GDP growth before 2008 was fueled by the excesses building up in the Shadow Banking system.

The US banking system is composed of three different layers and connected systems. The cause of the global financial crisis began in the early 2000’s, and took place in layers two and three and infected the top layer, the Cash or traditional banking system; the layer most think a bank does or should do, take deposits and make loans. The chart does not include any numbers, before and after the 2008 financial crisis, the size, breadth and critical links among entities and regulatory agencies spotlight essential market, extra-market and investment performance (loss) attribution tools. The front line banking and securities regulators span from the New York Federal Reserve, SEC, Federal Reserve, FDIC, OTS, FINRA (formerly known as NASD) and all the way to the State of Utah. Important influence came from certain industry trade groups like SIFMA, formerly known as SIA and the President’s Working Group on Financial Markets.

Banks’ purpose is to act as an intermediary within the economy to benefit the economy and help the Federal Reserve achieve its dual mandate; stable asset prices and full employment. They created and actually became their own extra-economy. Banks are obligated to operate according to “safety and soundness” not unlike safe driving laws we all know. All major bank CEO’s under oath, stated their agreement during congressional hearings (available on Cspan archives). The major US banks failed miserably however, to provide intermediation for the economy, instead deliberately dis-intermediated trillions of dollars worth of model – valued assets for themselves. This dis-intermediation amounted to over $16 Trillion dollars at the end of 2007. Another word for dis-intermediation is “leverage”. Most financial media reported the major banks’ leverage ratio. The first order arithmetic calculation however, was simply (and the more relevant) dollar amount of leverage. Why? Today the Fed is not buying a ratio, it is buying trillions of dollars worth of certain assets, hence the dollar amount of major banks’ leverage provides the most information and best explanation as the cause of the financial crisis and unnecessarily sluggish recovery to date including massive under-employment, not confined to the U.S.

MAJOR concept to understand (which explains almost all support by the Fed) is the values of most all “assets” in the Shadow Banking system were NOT based on “market” values, but on each major banks’ model of reality. In other words, each major bank made up its own definition of “market value.” The amount of these “assets, exposures and commitments” in excess of major banks’ equity at the end of 2007 was over $16 Trillion dollars, when US GDP was less than that in 2007. That may give a frame of reference for why in late 2013, the Fed has had to directly buy and still hold over $3 Trillion of US bonds and MBS. Some may ask, like Alan Greenspan, former chairman of the Federal Reserve, why would banks take such risks? It’s rather simple, it was “other people’s money” and the higher the values of assets (based on models) the higher certain individuals’ paychecks primarily at the major banks and five former CSE’s (Consolidated Supervised Entities). They were paid bonuses based upon a system of compensation called, Asset-based compensation.

Reversing the spin or disinformation aka confusion

Reversing the spin or disinformation aka confusion

Perhaps, an easier way to explain the how’s and why’s of the financial crisis and sub-anemic recovery

Major banks ran with standard 6 cylinder engines and 4 quarts of regular oil for many decades. In the 2000’s that changed. The cars changed into race cars with 50 cylinder engines but continued to run on the same 4 quarts of regular oil. They ran until 2008 when their engines seized up and stopped working. What was the oil? Oil was insufficient given the increase in the size of their engines and ironically was the very intermediation the major banks failed to provide. Thus to no one’s surprise (equipped with the relevant owner’s manual) their engines backfired simultaneously and once their hoods were lifted, exposed massively overvalued and concealed assets. The seizure happened in layers two and three of the Shadow Banking system and infected the cash / traditional system one might say, the public-facing, “television persona, friendly neighborhood, stadium-sponsor” banking system.

The Fed is in repair mode, by definition, unfortunately an impossible task. For as anyone knows, when a car engine seizes up, it is FUBAR (a WWII term meaning f’d up beyond all repair). Thus given the state of the major banks’ engines, there were and are only four options; 1) replace the car completely, 2) try to replace the engine, 3) use different means of transportation or the most remote option 4) decide transportation is unnecessary altogether.

Fiduciary Expert Chris McConnell’s 30 years of experience in the securities industry support insights into major banks’ self-created Shadow Banking system. The shadow banking system singularly created the housing overbuilding bubble, the housing price bubble, the 2007 stock market bubble, the foreclosure bubble due to unprecedented concealed massive amounts of dis-intermediated assets, implying total economic leverage of over 3,000 to 1. These factors caused US housing values to collapse, necessitating trillions of dollars of direct and indirect support from the Federal Reserve before 2008 to QE3 in 2013. The Fed’s $4 Trillion balance sheet today is still increasing by over $60 Billion a month of Mortgage Backed Securities purchases as continuing reminder of the gross amounts of dis-intermediation and leverage before 2008.

Understanding the players, connections of the entities in the diagram and numbers behind the diagram are essential to explaining nearly every investment and asset performance, RMBS losses and real estate foreclosure.

For more information info@fiduciaryexpert.com or (310) 943-6509

Copyright Chris McConnell & Associates 2014 All rights reserved