- There is little to no doubt proposed or actual tariffs will cause US consumer prices and wholesale prices to rise

- This will likely cause inflation to rise at the CPI and PPI levels

- This will likely cause interest rates to remain high and rise, despite safe haven-driven 10 YR UST’s recent advances

- This will likely cause debt service (interest on) US federal debt to rise and on

- All other forms and kinds of outstanding debt including: municipal and corporate debt and consumer debt: mortgages, automobile loans, credit card, student loans and BNPL loans and access thereto becoming more difficult, if not impossible

- The estimated delta of a 1% or 2% increase in interest rates on outstanding US federal debt ($36T) ranges between $360B and $720B

- NOTE: proposed or actual tariffs range up to 25% thus these increased debt services may be far higher

- Notwithstanding significant mark to market losses, if AFS (available for sale), on long US debt positions when rates rise including long US agency debt positions held by the Fed

- Elevated higher interest rates hinder the ability for the US to refinance its outstanding debt at lower rates

- Higher rates also hinder if not block the ability for other federal agencies, states, corporations, consumers, students, households and nonprofit organizations to refinance their outstanding debts at lower rates

- Higher interest rates are clear negatives for nearly all forms of capital market assets

- Business capex commitments and decisions while multi-nuanced nonetheless become more nuanced, more challenging, if not overwhelmed by complexity, policy-level capriciousness thus abandoned altogether

- Venture capital and private equity firm’s project funding will likely inexorably decline, effectively killing off thousands of often promising, edge research projects

- It’s not just that imported items’ prices will rise, likely significantly. US manufacturers, distributors and retailers will now have relative competitive “breathing room” to raise consumer prices on their own US-made products further ingraining price inflation into the supply chain and into final prices

- This will undoubtedly be recognized by US-based suppliers who will also likely see they have a little “extra breathing room” too and initiate higher prices charged to distributors and retailers

- Tariffs have an exceedingly long, well-studied history, and are among the so-called blunt instruments with a lot of known and knowable negative knock-on effects and other unintended consequences

- The cycle of nested price increases, and uncertainty (and fear, greed and other market emotions, reactions and behaviors) can snowball, and suddenly avalanche out of the control of policy makers’ tools and ability to reign it in

- No amount of bluster can talk it down or stop it once it becomes embedded into the expectations of all market participants

- If you have a foreign car, and it needs a part for repair or replacement, expect to pay more or any foreign-made product or piece of capital equipment that requires a foreign-made replacement part you will pay more, a lot more, if you can timely or even get it, as some foreign factories may curtail operations or shut down due to tariffs’ impacts on primary OEM products markets

- Higher prices lead to inflation and ceteris paribus higher COLA adjusted Social Security benefits payments

- Higher rates reduce pension plan benefits and annuity payouts

- Higher rates increase carry and other costs for any number of capital markets transactions, market participants and beneficiaries

- Global travel and tourism including study abroad programs will decline, including into the US

- Foreign consumers will tend not to purchase US-made goods and services including media, entertainment products and software

- US-based accounting, IT systems, consulting and engineering firms will see tougher times abroad

- Tariff-induced, higher prices lead to cutbacks in aggregate demand in the US and globally, not more

- Reductions in aggregate consumer demand in the US and globally augur and could trigger recessions, a decline in real economic growth worldwide

- Tariffs make sense best – on paper and in excel spreadsheets, not in the real world

- How could or will this happen? It’s an OBVIOUS TIMING MISMATCH

- The timing differences between 1) the time it will take for the claimed benefits of $5T of announced tariffs revenue and investments and 2) the actual completion of building new plants and factories in the US.

- Those plants will take years to come on-line, while construction workers will not now, but over the next few years, see thousands of new jobs, permanent jobs for new workers at those plants will take years

- What happens in the interim from now until 2027/2028?

- This timing mismatch concern was brushed off with – “of course, it takes time to build factories”

- Recessions, demand-side recessions in particular, themselves bring on a whole host of unintended consequences, knock-on effects, greater uncertainty and instability which the world needs less, not more of now

- One such likely underestimated knock-on effect is a sharp ramp up of foreign-made copies or knockoffs of US and other branded products and services, with design, manufacturing and software automation tools, often just a few mouse clicks away, leading to lost sales, diminution of brand value and costly dispute resolution

- But this could be both a demand-side and a supply-side recession overseas. Close to 30% of US companies’ sales come from overseas. The world has never seen such a broad set of circumstances in modern memory. The closest analog may be to the oil-embargo shock that took the global economy over a cliff in the early 1970’s through the early 1980’s

- The oil crisis of the 1970s, sparked by the Yom Kippur War in 1973, began with the Organization of Arab Petroleum Exporting Countries (OAPEC) imposing an oil embargo in October 1973, which led to significant price increases and shortages

- The oil shock catalyzed the spread of inflation and inflationary expectations which infected global in particular, the US economy. Fed chair Volcker’s war on inflation spiked US short term rates over 20% in the early 1980’s

- Federal Reserve Board governor Kugler discussed inflation expectations yesterday, April 2 here

- This sounds-good, populist mantra, made in America, may prove dear

- What may happen if, in the interim we face a new pandemic? Or a new extra-terrestrial threat? Or climate event?

- There is a small bite of good news however, for cheeseburger eaters, where pickles, onions, tomatoes, lettuce, and ketchup aside price increases may not occur, but for plant-based vegan and vegetarians expect to pay relatively more

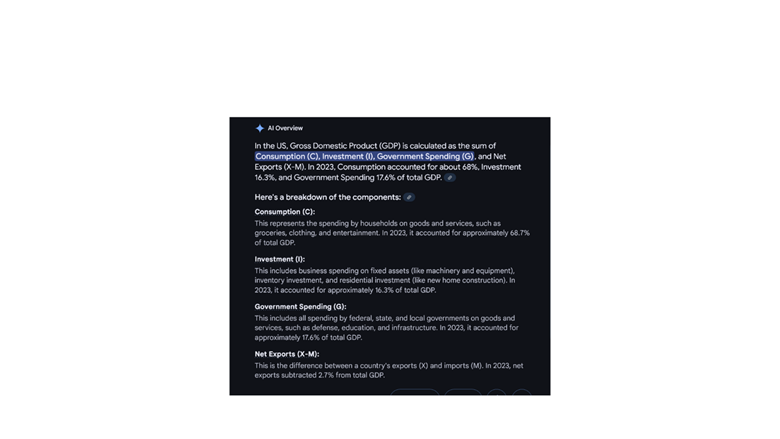

- Is this, when fully loading tariffs’ impacts on aggregate consumer demand, comprising over two thirds of US GDP, investment and government all together fully over 97% of US GDP, and promising research, liberation day? Or perhaps it might be more aptly named something else.

- The US Trade Representative report on trade barriers is here

From the taxfoundation.org

Policymakers may want to use the revenue generated by tariffs to offset the revenue losses from extending the expiring provisions of the 2017 Tax Cuts and Jobs Act (TCJA). Using Tax Foundation’s General Equilibrium Model, we estimate that making the individual provisions of the TCJA permanent would reduce federal tax revenue by $3.4 trillion, the estate tax provisions by $200 billion, and the business tax provisions by $643 billion, for a combined $4.2 trillion revenue loss over the next decade.

Universal tariffs of 20 percent would not raise enough revenue to offset the revenue loss of individual permanence alone. But those same tariffs would cause enough economic damage, especially if met with any foreign retaliation, to offset the entire economic benefit of making the individual provisions permanent. In other words, attempting to “pay for” making the individual provisions permanent by imposing universal baseline tariffs would cause a net reduction in tax revenues and economic output, while simultaneously increasing the tax burden on lower- and middle-income taxpayers.

Lawmakers will need to pursue fiscal responsibility as they address the tax law expirations, but fiscal responsibility requires finding sound ways to pay for spending priorities. Tariffs don’t make the cut.

Perhaps – proposed or actual tariffs might be put on ice, for a long time

Old alliances, partnerships and trade patterns – are gone, never to be seen again

The mostly if not nearly all negative impacts of proposed, actual and implemented tariffs on international relations, alliances and trade blocs is significantly underestimated and will have far reaching repercussions for many years and across many potential and actual conflicts existing or bubbling across the globe. None of these tariff decisions whether US-based or foreign-based happen or will happen in a policy vacuum they are now new, inextricable X-factor ingredients and all part of the policy level salad

One last observation – comes from the real threat to jobs by the TripleTsunami™

Briefly, the TripleTsunami™ is the combination of AI / ML/ and QC. AI is artificial intelligence, ML is machine learning and QC is quantum computing. AI and ML on their own threaten to displace millions of workers, including high-paying jobs held by coders and engineers. Nearly all jobs are at risk of disappearing.

While, since little to nothing in business, commerce or policy happens in a vacuum, the recent wholesale layoffs in the public sector are well-observed by private sector employers which will likely worsen job losses and uncertainty currently. Job losses lead to declines in aggregate demand and other negatives not limited to homelessness and worsened physical, mental and emotional health outcomes.

When you layer in QC quantum computing it takes those AI and ML capabilities to a whole new level. How? While not widely covered in mainstream media, QC provides a giant leap in computing power and speed. Up to 160 million times faster than today’s fastest supercomputers. Pause, take an intentionally-long breath, let that sink in. Thus in a nutshell, the TripleTsunami™ can and will 1) create new industries, millions of new jobs and discoveries and 2) destroy far more millions of jobs. Then what? What does that mean for US and global aggregate consumer demand? Lots of headaches. Lots of policy decisions that have never been faced before. Lots of new spreadsheets and what-when-if scenarios.

One additional, not-little thing. QC will likely be able to decrypt / break all data security algorithms for ALL forms of data, communications and transactions both at-rest and in-transit, past and present. HNDL and SNDL are schemes perpetrated by bad actors. HNDL is harvest now, decrypt later. SNDL is save now, decrypt later. What DO they mean? Bad actors can, have and will access (hack into) data, save it and when QC becomes available, use it to decrypt and use that data for ransomware and other nefarious purposes. Since data accounts for and supports much of the value chains in organizations and more so each day, today’s values can may and will be deeply threatened.

We’ve coined a new term reflecting what many, not all, AI LLM’s produce – Koki™ Known or Knowable Intelligence™

Fiduciary duty: (btw, BFD in the title means breach of fiduciary duty)

How does this impact fiduciary duty for trustees, boards, and third-party fiduciary agents not limited to: financial advisors, broker dealers, banks, trust companies, custodians, record keepers, third party administrators, wealth managers, private bankers and others? Or claims involving breach of fiduciary duty? Do you know the: what, when, where, how and by whom fiduciary duty arises, exactly? Breach of fiduciary duty claims often date back several decades when beneficiaries were minors. How may or will trust beneficiaries be negatively impacted? How will closely-held or family-owned businesses be negatively impacted?

Tariffs will also impact divorce*, marital separations, bifurcations, QDRO’s and marital settlement agreements. How will tariffs impact such agreements and valuations, how much are tariffs to be weighed, considered, reflected in such settlements. An increasing number of divorces are more complicated than just husband and wife or partner / partner with or without formal jobs, occupations or careers. Divorces increasingly involve businesses, partnerships, intricate funding by both separate and community property (and from third parties) for business interests including IP (copyrights, trademarks, patents), digital rights and interests.

So how might (not if) actual tariffs including for businesses whose commerce crosses international borders (US, Canada, Mexico, EU, South America, Asia, Africa, Australia) now and in the future affect valuations and property settlement agreements, spousal support and child support?

In sum, all assets, cash flows in and out, insurance thereon, and liabilities, will require a tariffs and potentially AI/ML/QC-based adjustment schedule.

*Divorces carry a marital fiduciary duty spouses/partners owe to each other including during the pendency of the divorce/separation and for months thereafter, these duties apply to all forms of property whether separate or community including the complicating duties of each wearing the hats of business owner, LLC member or partnership partner, property owner, books and records custodian, bookkeeper, tax reporting such as 1099’s and W-2’s, employee / contractor benefits, filings and payments, etc.

Divorce and marital separation filings are rarely total surprises, so prior to and during the divorce accounts subject to ATRO’s need to be inventoried and scrupulously monitored including upon each spouse’/partner’s assets, liabilities, stock grants, awards, stock options, forgivable loans, sunset / retirement programs, changes of commissions or fee splits, partial transfers, shifts of or complete books of business/customer accounts/client lists, deferred-compensation accounts.

Pension benefit and retirement accounts such as 401k’s, 403b’s, 457’s, IRA’s, IRA-rollovers. Other employer-based accounts such as ESOP’s and ESPP’s. And HSA, 529, Coogan’s, UGMA /UTMA, As well as accounts held directly at mutual fund companies, employers, at issues via DRIP programs and securities held at stock transfer agents.Hard to trace/monitor cryptocurrencies and other digital assets accounts.

And of course, bank, safe deposit boxes, safes at home and at work, credit union and brokerage accounts, credit cards, HELOC’s, credit lines, annuities, insurance and other accounts such as frequent flier, hotel, card rewards and casino accounts.

Heightened attention on assets owned by/in trust including carefully reviewing the operative trust agreements and any and all amendments thereto. And any and all pending lawsuits, arbitrations, class action matters, insurance claims such as for disability as well as Social Security and other public benefits. And valuable collections such as: classic or vintage cars, coins, stamps, baseball cards, memorabilia, wine, guns, artwork, racehorses and other animals. And tennis, country and social club memberships.

And fundings of, positions in, influence, interests and or control including as covered-persons in tax – exempt organizations, non-profits, foundations and endowments

As if that were not enough, tariffs will significantly impact insurance claims and the rebuilding of the LA wildfire communities, Altadena and Pacific Palisades including residential, commercial, religious, educational, parks and recreational and healthcare facilities as well as all infrastructure roads, sewerage systems, electrical grids, gas pipelines and transportation making some and or many of these projects untenable. Perhaps, policy makers at the federal, state, county and local levels could and might provide economic and or financial accommodation for these victim communities?

Copyright Chris McConnell & Associates 2025. All rights reserved in / on all media.